Assignment Brief

Operating Budget Comprehensive Analysis: Silver Spoon is a large British-Italian hospitality company, which serves the UK market. It focuses on three important areas of hospitality: Travel and Tourism; Food Services; Banquet and Events. The company employs around 5,000 people nationally, and provides services in 12 regions across the country as shown in the map above and is committed to ensuring a reliable supply of its services where and when they are needed. The hospitality market is becoming more competitive and development cost are rising. Businesses in the industry around the UK are restricted by the boom in European holiday destination, but is expected to improve in the long term with BREXIT. Cruise ships, airlines, agencies & tour operations including luxuries services such as luxury brand managements, sales and marketing for international brands and contract often provides additional work for the travel and tourisms division of Silver Spoon.

In 2017 its total sales revenue was £18.5 million. Total sales for 2017 has gone down and so has net profit % and development cost went up to 40% compared to previous years. The directors think they should do more to try and improve their sales and profits and should expand the business.

Imaging you are the Budget Analyst (Manager) for the company. You have recently been invited to attend the company board meeting where the directors who are experienced businessmen discussed their plans to expand the level of business activity for the company to include other sectors of the hospitality

industry. The CEO believes that owning different sectors of the hospitality industry will offer Silver Spoon a chance to rake in more rewards in the long haul and improve the financial appearance of the company.

The research from the marketing department shows there are strong demand for certain types of services within the hospitality industry and there exist within the company current business model, sufficient capacity to increase revenue substantially by 50%, with the company Asset to sales revenue (Asset turnover ratio) of 1.707 and total assets of 10.8 million (Revenue/total assets). The directors needs to choose between two different plans for organizing the activities of Silver spoon in providing these services for which there exist a strong demand.

The following ideas are put forward at the board meeting and the expansion will involve one or two of the following:

- Bed & Breakfast

- Holiday lettings

- Campgrounds and Convention Centres

- Villas, Suits and Resorts

- Café • Restaurant & Bars

- Takeaway and Fast food

- Sports and Gaming

- Nightclubs and bars

- Catering

Required: The directors have asked you to draft a report to be addressed to the company board of directors on the proposal and prospects of Silver Spoon that will set out the following:

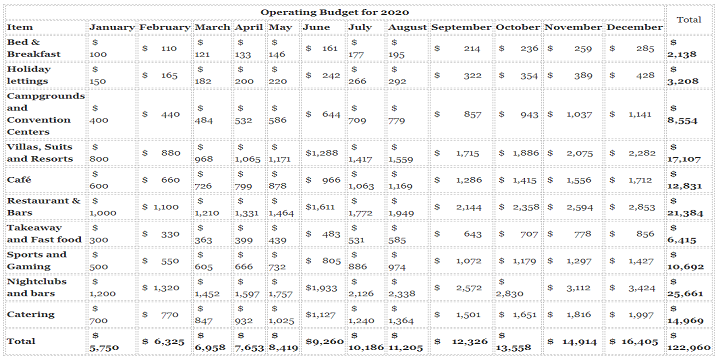

A) An operating budget for the next 12 months that relate to the company’s expected activities and objectives for 2020.

B) An assessment of the financial implication of the proposal for expansion and the implication on the company performance.

C) An evaluation of the effectiveness of budgeting as a tool for decision making, planning and control for a small and medium scale enterprise such as Silver Spoon Ltd.

Notes:

- Assume that a year consists of 12 months of equal lengths

- The company plans to starts the expansion on 1 January 2020

- Operating profit margin of 15-20%

- Ignore taxation

Solution for Operating Budget Comprehensive Analysis

A) An operating budget comprehensive analysis for the next 12 months that relate to the company’s expected activities and objectives for 2020

B) An assessment of the financial implication of the proposal for expansion and the implication on the company performance.

Assessment of the financial implication of the proposal for expansion of business

As a Budget Analyst (Manager) for the company of hospitality, I asses the expanded client request and blasting deals aren’t sufficient to reveal to you it’s a great opportunity to grow. Because clients will purchase more, doesn’t mean you would profitability be able to move more. Thinking about an assortment of variables identified with expanding your business, you can make a supportive money related investigation to decide if it’s a smart thought to grow your business.

Projected Sales

As a Budget Analyst (Manager) for the company of hospitality, my primary investigation you should make while considering a development is the business increment can reasonably anticipate. In a few occurrences, extending to take care of expanded demand can cost more than the expansion in income. To adequately ascertain regardless of whether a development bodes well, compute hopeful and moderate deals and income projections so you can play out the different examinations against these numbers. (Ashe-Edmunds, 2017)

Expansion Cost

As a Budget Analyst (Manager) for the company of hospitality, I assess that a few extensions incorporate one-time buys, for example, new hardware or another area, or momentary costs, for example, a promoting effort or staff enrollment and preparing. Ascertain the underlying expenses of an extension, which do exclude progressing working expenses, to help decide when I will equal the initial investment and begin making a benefit. (O’Farrell, 2017)

Operating Costs

As a Budget Analyst (Manager) for the company of hospitality, I ascertain the expanded working expenses after an extension begins. This may incorporate more staff and supplies, expanded lease and utilities and apparatus or gear support. Decide the numbers for generation and overhead expenses. When I know these figures, decide your potential net revenue per unit and aggregate gross benefits dependent on the two deals and income figures. (Markgraf, 2017)

Effect on Cash Flow

As a Budget Analyst (Manager) for the company of hospitality, I think that satisfying more requests regularly implies broadening more credit while expanding your costs. I should pay for materials and staff time to deal with new business, while sitting tight for installment for these requests. Decide whether I can meet the money needs dependent on present money and accessible credit, the credit terms you offer clients and your two deals situations. An extension may expect to apply for a new line of credit, arrange new seller and provider installment terms and to change the credit terms I offer clients and customers.

Calculate Return on Investment

As a Budget Analyst (Manager) for the company of hospitality, When I comprehend what the start-up and working costs will be, potential deals volumes and gross benefits, ascertain your arrival on venture by subtracting your aggregate costs. Do this twice: Make one computation up to the point that I pay back the underlying development costs, and perform one figuring for the period after I just have working expenses. On the off chance that I can rapidly pay back your underlying start-up expenses and make a benefit subtracting working expenses from incomes, the extension may be supported. On the off chance that it takes a long time to satisfy the underlying expenses and I make a humble rate return on the venture, other speculation openings may be a superior decision. Compute the rate return on your venture under the two situations and decide whether I can make a higher come back with different speculations, and if the pressure put on your present activities – including staff – merits the ROI I can anticipate from your development. (Munro, 2015)

Assess the financial implication on the company performance

As a Budget Analyst (Manager) for the company of hospitality, the vital and money related outcomes are firmly connected, and the execution in one zone can affect the other. An abnormal state of budgetary execution may result from a successful methodology, yet great money related outcomes let you seek after systems that require generous speculations. When I create compelling procedures and execute them so they accomplish the ideal money related outcomes, they can give the adaptability to seek after extra key activities.

Measuring Performance

As a Budget Analyst (Manager) for the company of hospitality, Before I can assess execution suggestions, I need to characterize the objectives of money related and key activities. What exactly degree I have come to the monetary and vital targets you set characterizes the dimension of execution you accomplished. In the event that execution isn’t uniform, I can check whether poor execution in one region had suggestions in the other. For instance, you can check if low vital execution prompted poor budgetary outcomes or whenever fizzled monetary ventures prompted insufficient technique execution on account of absence of assets. Deciding such collaborations depends on the precise estimation of execution in every region. (Markgraf, 2017)

Arrangement of Goals

As a Budget Analyst (Manager) for the company of hospitality, regardless of whether key and money related execution are both brilliant, the objectives each seeks after need to fortify each other for the organization to understand the most elevated advantages. For instance, if the key objective is to build piece of the overall industry while monetary objective is a high benefit, I may accomplish both, however they are in struggle. I could have expanded piece of the overall industry significantly more on the off chance that I had acknowledged a lower benefit and put more in the promoting exertion. Then again, the benefit may have been considerably higher in the event that I had not placed cash into expanding piece of the overall industry. A reasonable heading and a coordinating of money related and key objectives prompts incorporated activity and better outcomes. (Randall, 2003)

Critical Aspects of Financial Performance

As a Budget Analyst (Manager) for the company of hospitality, while vital disappointments may have negative ramifications for an organization, money related disappointments can regularly compromise its reality. Basic monetary measurements incorporate the capacity to pay workers and providers, the liquidity to benefit obligations, the money to put resources into the business, and the organization’s reliability. In any vital activity, I need to give careful consideration to these parts of an organization’s funds and guarantee that the system does not put the business in danger. (Fontinelle, 2017)

Financial Components of Strategy

As a Budget Analyst (Manager) for the company of hospitality, the procedures that enhance organization execution or develop the business for the most part incorporate money related segments. When the basic money related components are distinguished and anchored, I can investigate the budgetary ramifications of the technique. For instance, the advancement of another item may at first decrease productivity. When the item is propelled effectively and deals volume develops, income increments and benefit bounce back. In the develop item stage, income levels off and productivity increments. Indicating the money related ramifications of your key activities gives you a chance to make compelling utilization of monetary assets. (Randall, 2003)

c) An evaluation of the effectiveness of budgeting as a tool for decision making, planning and control for a small and medium scale enterprise such as Silver Spoon Ltd

Decision making

To start, Budgeting gives a premise to coordinate and assess on the base of execution between authoritative divisions, auxiliary condition or person’s exercises and furthermore offers thoughts to decide. Specifically, Budgeting can execute and impacts through various appearances to the associations by means of inside or remotely. It is a dynamic money related instrument to settle on choices so as to potential effect on organization’s monetary execution particularly for the extensive organizations however all around planned spending plan can be exceptionally viable for SMEs organizations. For example, the formal planning procedure can investigate the exhibitions of SME organizations by involving real and planned exhibitions which can be influenced decidedly to the SMEs. Planning exercises qualify future necessities by planning, assessing, organizing, controlling correspondence, and gives increasingly various examples. Additionally, budgetary support enhances the administrative exhibitions of SMEs and furthermore enhances the sharing, trading data to the all dimensions of the board. Financial plan planning and controlling are similarly critical for any sort of organizations so as to accomplish budgetary solidness and targets. Especially monetary planning and decision making improves organization’s practicality towards SMEs and center organization’ achievement. As pursues, money related achievability empowers and assesses what changes should be done to create more benefit, measure of assets required as a speculation or working capital, or if the venture conveyed whether sum can be reimbursed and so forth. Besides, Budgeting encourages a SME to seek after thoughts and dreams for the future by taking choices as per existing money related circumstance and furthermore gives a plan to investigate new items in the market by decreasing expense and dissecting monetary danger of the market. Planning likewise gauge money related exhibitions and enables business administrators to settle on choices whether they have to do extra minutes to accomplish deals targets. SMEs organizations need to produce more cash as income to make more benefit as indicated by plan, consequently planning plays as a weapons for the business chief to settle on choices and recognize issues. (Bhowmik, 2016)

Planning

Since planning is at the core of a planning procedure, by utilizing the planning procedure perseveringly, organizations can design widely on the best game-plan to accomplish the association’s objectives. As a planning help, spending plans considers the refinement and evaluation of the long haul marketable strategy into transient activity designs whereby elective arranging situations might be analyzed and an “imagine a scenario where” examination connected. Without the yearly planning procedure, the weights of day-today working issues may entice supervisors not to get ready for future tasks. The planning procedure urges directors to envision issues before they emerge, and hurried choices that are made on the last minute, in view of practicality instead of contemplated judgment will be limited. (Mulani, 2015)

Control

Toward the start of the period, the financial backing is an arrangement. Toward the finish of the period, the monetary allowance is a control device to quantify execution against desire with the goal that future execution might be moved forward. Control is accomplished through ceaseless announcing of genuine advancement and consumptions with respect to plans, which is a financial plan. It infers that execution assessment regularly is utilized in vast association and in association with clear and detectable assets. (KPODO, 2013 )

References

Ashe-Edmunds, S. (2017). Operating Budget Comprehensive Analysis. [Online]

Bhowmik. (2016). Operating Budget Comprehensive Analysis. [Online]

Fontinelle, A. (2017). Operating Budget Comprehensive Analysis. [Online]

KPODO, V. K. (2013 ). THE ROLE OF BUDGET AS A TOOL FOR MANAGERIAL DECISION MAKING IN SMALL AND MEDIUM SCALE ENTERPRISES. THE CHRISTIAN SERVICE UNIVERSITY, 01-45.

Maduekwe, C. C. (2016). The use of budgets by small and medium enterprises in Cape Metropolis, South Africa. Problems and Perspectives in Management, 14-16.

Markgraf, B. (2017). Strategic & Financial Performance Implications: Operating Budget Comprehensive Analysis. [Online]

Mulani, J. (2015). Effects of the budgetary process on SME’s performance study based on Selected SME. Research Journal of Finance and Accounting , 135-155.

Munro, C. (2015). Company Growth: Business Expansion Risks & Challenges.

O’Farrell, R. (2017). The Impact of Finance on Business Growth: Operating Budget Comprehensive Analysis. [Online]

Randall, T. (2003). Performance Implications of Strategic Performance Measurement in Financial Service. Accounting, Organizations and Society, 715-741.

Written by

Email: [email protected]