1 Introduction – NPV IRR PAYBACK

The concept of finance and financial tools (NPV IRR PAYBACK) are very much effective for getting an investment decision in a particular project regarding whether the project investment is able to generate return from the investment or not. An investment is called a justifiable investment when the investment has positive return and investment is able to fulfill at least all financial requirements (Khan and Jain, 2007). There are some financial as well as non-financial factors that influence the investment decision.

In this particular study, XYZ plc, planning to invest in two projects- software and Launderette project. For that investment evaluation on those two projects, capital budgeting financial tools of Net Present Value (NPV) and Payback Period (PBP) will be used. .

2.0 Payback Period

2.1 Payback calculation – PROJECT A

| Years

|

Cash flow | Cumulative Cash flow |

| 0

|

(£100,000) | (£100,000) |

| 1

|

£28,000 | (£72,000) |

| 2

|

£32,000 | (£40,000) |

| 3

|

£35,000 | (£5000) |

| 4

|

£55,000 | £50,000 |

|

5 |

£78,000 | £128,000 |

|

Payback Period = A+ B/C |

||

Here,

A = The last time scale of negative cumulative cash flow in this given time frame

B = Absolute value

C = Cash flow

Payback of A = 3+ [(5000/55000)*12] year

= 3 years and 1.09 months

2.2 Payback calculation – PROJECT B

| Year

|

Cash flow | Cumulative Cash flow |

| 0

|

(£120,000) | (£120,000) |

| 1

|

£31,000 | (£89,000) |

| 2

|

£38,000 | (£51,000) |

| 3

|

£43,000 | (£8,000) |

| 4

|

£64,000 | £56,000 |

|

5 |

£89,000 | £145,000 |

|

Payback Period = A+ B/C Payback of B = 3+ [(8000/64000)* 12 ] year = 3 years and 1.5 months |

||

3.0 Net Present Value

3.1 Net present value Calculation – PROJECT A

| Year | Cash Flow | DCF | PV |

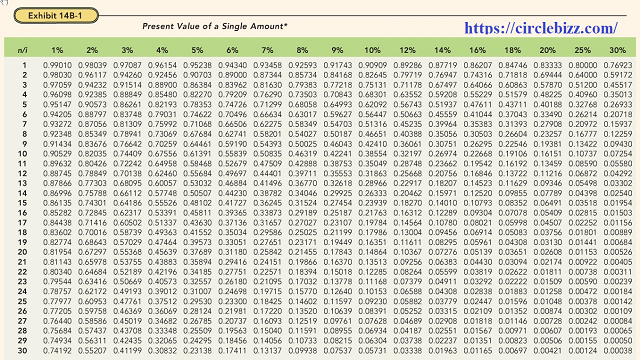

| 0 | (£100,000) | 1.000 | (100,000) |

| 1 | £28,000 | 0.901 | 25,228 |

| 2 | £32,000 | 0.812 | 25,984 |

| 3 | £35,000 | 0.731 | 25,585 |

| 4 | £55,000 | 0.659 | 36,245 |

| 5 | £78,000 | 0.593 | 46,254 |

| NPV | 59,296 |

3.2 Net Present Value Calculation – PROJECT B

| Year | Cash Flow | DCF | PV |

| 0 | (£120,000) | 1.000 | (120,000) |

| 1 | £31,000 | 0.901 | 27,931 |

| 2 | £38,000 | 0.812 | 30,856 |

| 3 | £43,000 | 0.731 | 31,433 |

| 4 | £64,000 | 0.659 | 42,176 |

| 5 | £89,000 | 0.593 | 52,777 |

| NPV | 65,173 |

4 Analysis

4.1 Payback Period

Payback period provides decision regarding investment appraisal on the aspect of considering minimum time period to recover primary investment.

From, the above calculation of payback period, it is seen that the result estimated for both project under payback terms are almost similar.

Therefore, the result is as below:

Payback of Project A – Software Project is 3.09 years whereas payback of Project B – Launderette Project paybacks in 3.13 years.

As, the decision criteria for payback is that if the project have payback period less than project life time, then that particular project is evaluated for investment decision. So, it is evaluated that Software Project (Project A) is comparatively taking less time for getting back initial investment. So, Software Project (Project A) should be accepted for investment.

4.1.1 Benefits of Payback Period

Payback period capital budgeting tools is beneficial for appraising an investment in terms of time period (Lin, 2010)

- The simplicity of calculation process in payback makes it popular

- The level of easy understanding within a short time by payback makes it popular,

- It works well when management resource is limited (Lin, 2010)

- It needs minimum requirement for financial data

- If management thinks to use a screening device for decision making, then payback is effective tools.

4.1.2 Drawbacks of Payback Period

Tough there are some beneficial things of payback method but still this method has some limitations also. .

Neglect of time value of money:

If any financial tools do not consider the factor of time value of money, this obviously a limitation. Likewise, this case is very similar for payback period it neglects the theory and application of time value of money (Peterson and Fabozzi, 2002).

Neglected cash flows after the payback period:

Generation of cash flow in an investment may at year end, but payback does not consider the cash flows after the payback period.

Doesn’t consider returning the project on investment:

In an investment project, there have the factor of required rate of return or ate or return, but payback doesn’t consider that rate of return form capital investment (Peterson and Fabozzi, 2002).

Not Realistic

This method is simple but this method is not real as payback does not consider normal business scenarios.

Ignores Profitability

Measuring profitability from a project at year end is a common things but payback does not consider profitability as it ignores the cash flow generation at year end. .

Not all cash flow was covered

Payback only consider initial investment but not considered the return from the investment which is called cash flows coming in later years (Peterson and Fabozzi, 2002).

4.2 Net Present Value (NPV)

Net present value is the difference between cash inflow and cash outflow as discounted. The decision aspect of net present value is realized as when the NPV is larger than zero, then it is called an accepted project (Creemers, 2016).

From the above NPV calculation, it is estimated that Software project NPV is £59,296 and Launderette project NPV is £65,173. Comparatively, Launderette project NPV is higher and it is still larger than zero. So, it would be better to accept the Launderette project for investment due to its higher NPV.

4.2.1 Benefits of NPV

The NPV method is the most valid of all the capital project appraisal methods.

- The theory and application of time value of money is considered for NPV

- All kinds of cash flows between the project periods are also considered.

- NPV technique helps to get the idea whether the project investment Is going to create value or not(Peterson and Fabozzi, 2002).

- It takes in to consideration risk inherent in the project investment

- It takes into account the cost of capital of the project investment

- The decision making approach by using NPV is highly recommended (Yaghoubi, Locke and Gibb, 2012)

4.2.2 Drawbacks of NPV

- NPV tool does not work well when it is the matter of comparing two projects of different size.

- It is highly sensitive to the discount rate used

- It ignores the sunk cost

- NPV may not boost the return on equity (Yaghoubi, Locke and Gibb, 2012)

4.3 Possible non-financial factors that could influence an investment decision

There are some non-financial factors that influence the investment decision which researcher must need to consider as it is equivalently important for decision taking purpose:

- The current and future legislation issues may impact on business operation

- The effective management of staff by motivating them, improving skill, so on

- Building strong relationship with customer

- The business ethics and ethical issues in business operation to maintain

- Business goodwill and developing other business community relationship

- Government regulation that should be followed strictly (Khan and Jain, 2007)

References

Creemers, S., 2016. Moments and Distribution of the NPV of a Project. SSRN Electronic Journal, 4(1), pp.89-95.

Khan, M. and Jain, P., 2007. Financial Management. New Delhi: Tata McGraw-Hill.

Lin, H., 2010. Why Should Managers Like Payback Period?. SSRN Electronic Journal, 2(1), pp.29-32.

Peterson, P. and Fabozzi, F., 2002. Capital Budgeting. New York, NY: Wiley.

Yaghoubi, R., Locke, S. and Gibb, J., 2012. Net Present Value of Acquisitions. SSRN Electronic Journal, 4(2), pp.65-69.

NPV IRR PAYBACK, NPV IRR PAYBACK is prepared by

Written by

Email: [email protected]