Investment Appraisal Techniques are used in making Capital Investment Decisions

Introduction

Investment Appraisal Techniques for Capital Investment Decisions are reliable sources of techniques for taking investment decision. George Manly Plc is the organization of House Building Firms. This report will focus on the investment appraisal techniques used by George Manly Plc for decision making purpose of investment. Therefore, as a Senior Management Accountant of this firm, I will present this report to the Board of Directors regarding the investment appraisal techniques that will be used for talking investment decision in building house of 100 numbers by George Manly Plc in development site for the next four years. As a Senior Management Accountant of this firm, I would like to mention that there are different techniques of investment appraisal those are known as capital budgeting techniques. They are globally recognized as well used by the investor analysis for decagons making regarding the investment on capital expenditures alternatives. So, those techniques are Net Present value-NPV, Internal rate of Return-IRR, Accounting rate of return-ARR, Payback Period Period-PBP. As a Senior Management Accountant of this firm, my role is to present the benefits of using those investment appraisal techniques, problems of using those investment appraisal techniques and the limitations of using those investment appraisal techniques. Finally, I will present the calculation of those given data regarding using investment appraisal techniques and comment on those results for ensuring the viability of the investment by George Manly Plc.

Payback period

Payback period is one of the capital budgeting techniques used in decision making for investment appraisal where it covers the time period for recovering the initial investment at minimum time period (Block, 2019).

Pay Back period is considered as the risk index indicator because this technique allows initial cash inflows and ignores the investment at later part time on which it is possible to recover the earlier investments.

The formula of Payback period is as follows:

But the scenario of investment and cash flows scenario will be uneven, it is recommended to use the following formula as follows with every year’s cumulative net cash flow:

Here,

- A = A implies the negative cumulative cash flow at the last time period in the time frame

- B = B implies the cumulative cash flow of the period at end that will be absolute value

- C = C implies as the total cash inflow for the time period as of following period A

Decision Criteria

It is recommended that Payback period must be smaller than the project life.

- So, if the calculated result of payback period is smaller than the given project life, then it is decided to accept the project investment (Bierman and Smidt, 2007).

- Again, if the calculated result of payback period is larger or greater than the given project life, then it is decided to reject the project investment (Bierman and Smidt, 2007).

- Moreover, if the calculated result of payback period becomes zero, the investment appraisal decision will be neutral where some factors of investment appraisal will be considered as overall consideration (Bierman and Smidt, 2007).

Benefits of Payback period in Investment Appraisal Techniques for Capital Investment Decisions

Payback period has the following benefits regarding investment appraisal:

- It helps to take decisions regarding recovering earlier investment (Foerster, 2015)

- The result of early payback from initial investment helps to measure the liquidity position of the firm in terms of cash inflows (Foerster, 2015)

- It helps to identify the investment risk (Foerster, 2015)

- It is the most easiest, simplest and reliable technique to measure the shortest time frame of recovering investments (Foerster, 2015)

- The concept of payback period is easy to understood by the user as well as researcher

Demerits and Limitations of Payback period in Investment Appraisal Techniques for Capital Investment Decisions

Payback period has the following demerits and limitations regarding investment appraisal:

- Payback period has the limitation of considering the timing of cash inflows whereas it is the demerit of taking correct investment decisions (Mukherjee, 2008)

- Payback period has the limitation of considering time value of money whereas it is the demerit of taking correct investment decisions (Mukherjee, 2008)

- Payback period ignores the profitability of the project when it has shorter payback

- Payback period ignores the produced cash flows after end of PBP and also ignores the total return of the project (Mukherjee, 2008).

- It ignores the concept of ROI-Return on Investment of the project as it only limits to short term investment as well as initial investment (Mukherjee, 2008)

Accounting Rate of Return

Accounting Rate of Return is another recognized capital budgeting techniques used in decision making for investment appraisal where it helps to rank the projects valuation according to their net earnings (Block, 2019).

Accounting Rate of Return is confirmed as the ratio of calculating the net earnings of the profits against the net investment of the project.

The formula of Accounting Rate of Return is as follows:

Here,

- Average Accounting Profit = It implies the mean of the net earnings from a project for the given time frame or project life.

- Average Investment = It implies the initial investment with end investment where the result will be divided by 2.

Decision Criteria

It is recommended that accounting rate of return must be greater than the required Accounting Rate of return.

- So, if the calculated result of Accounting Rate of return is greater than the required Accounting Rate of return, then it is decided to accept the project investment (Bierman and Smidt, 2007).

- Again, if the calculated result of Accounting Rate of return is smaller or lower than the required Accounting Rate of return, then it is decided to reject the project investment (Bierman and Smidt, 2007).

- Moreover, if the calculated result of Accounting Rate of return becomes zero, then the investment appraisal decision will be neutral where some factors of investment appraisal will be considered as overall consideration (Bierman and Smidt, 2007).

Benefits of Accounting Rate of return in Investment Appraisal Techniques for Capital Investment Decisions

Accounting Rate of Return has the following benefits regarding investment appraisal:

- ARR is very simple to calculate the results as it only allows the net earnings and net investment of the project in response to the project useful life over the entire time period of project (Oldcorn and Parker, 2006).

- It allows to use net earnings, therefore it provides the good appraisal for taking decision of investment (Oldcorn and Parker, 2006).

- It provides the clear scenario of project profitability (Oldcorn and Parker, 2006).

- As, ARR considers the concept of accounting profit, so the result of profit part is viable to consider.

- To evaluate the present performance, ARR is very helpful (Oldcorn and Parker, 2006).

Demerits and Limitations of Accounting Rate of Return in Investment Appraisal Techniques for Capital Investment Decisions

Accounting Rate of Return has the following demerits and limitations regarding investment appraisal:

- The limitation of ARR is of ignoring time factor whereas it is the demerits of selecting alternative resources as time value of money are not considering, therefore it will not supply a result of economic consideration (Peterson and Fabozzi, 2002).

- The limitation of ARR is of ignoring the external factors like inflations, so, it is disadvantageous to get the correct scenario of project’s profitability (Peterson and Fabozzi, 2002).

- ARR ignores cash inflows of the project, therefore the estimation of accounting profits may not be the accurate scenario (Peterson and Fabozzi, 2002).

- The demerit of ARR is that it is applicable for those projects where there have investment in the projects part by part in intervals (Peterson and Fabozzi, 2002).

- The limitation of ARR is of ignoring project life period at different investments, as a result the initial investment or average investment will be remain same (Peterson and Fabozzi, 2002).

- In project evaluation, ARR is not the good option because it can be calculated different ways, therefore it has consistency problem in calculation (Peterson and Fabozzi, 2002).

Net Present Value

Net Present value is the most acceptable techniques in capital budgeting techniques used in decision making for investment appraisal (Block, 2019).

Net Present value is the difference between summation of discounted cash inflows and the summation discounted cash outflows. To analyze the project’s profitability, the techniques of NPV is used.

The Formula of Net Present Value as follows:

When the cash flow of the project is even, the following formulae is widely used:

Here,

R= R is recognized as the expected cash inflows from the project within the given period of time

i = i is recognized as required rate of return or the discounting rate or the cost of capital

n = n is recognized as the number of time or useful life of the project

On the other hand, when the cash flow of the project is uneven, the following formulae is widely used:

Here,

R= R is recognized as the expected cash inflows from the project within the given period of time

i = i is recognized as required rate of return or the discounting rate or the cost of capital

Decision Criteria

It is recommended that Net Present value must be greater than Zero.

- So, if the calculated result of Net Present value is greater than Zero, then it is decided to accept the project investment (Bierman and Smidt, 2007).

- Again, if the calculated result of Net Present value is smaller or lower than the Zero, then it is decided to reject the project investment (Bierman and Smidt, 2007).

- Moreover, if the calculated result of Net Present value becomes zero, then the investment appraisal decision will be neutral whether the overall techniques of capital budgeting could be utilized for decision making purpose (Bierman and Smidt, 2007).

Benefits of Net Present Value in Investment Appraisal Techniques for Capital Investment Decisions

Net Present Value has the following benefits regarding investment appraisal:

· Assumption of Reinvestment

NPV is advantageous in decision making for investment appraisal because it considers the aspect of reinvestment assumption where it is evaluated that project’s cash flows shall be reinvested at the rate of IRR (Slorach, 2000).

- Considers Time value of Money

NPV is advantageous in decision making for investment appraisal because it considers the aspect of Time value of money because without considering the factor of tie value money the accurate result could not be evaluated, and then the result shows that the result is equivalent to the cost of the price in today is not similar to the price of next days, or the value of money today must be larger than the value of money of next day (Slorach, 2000).

· Accepts Conventional Cash Flow Pattern

NPV is advantageous in decision making for investment appraisal because it accepts the aspect of conventional cash flows because if there have any investment in the interval of project, NPV is the reliable techniques to calculate the result of conventional cash flow pattern. Therefore, it seems that NPV allows to use all cash flows towards the project during the given period of time, and it is highly recommended to use all kinds of cash flows in the analysis of investment appraisal to take right decision for investment (Slorach, 2000).

- Good Measure of Profitability

NPV is very useful in decision making for investment appraisal because it is the most reliable technique to measure profitability of the project (Slorach, 2000).

· Factors Risks

NPV is very useful in decision making for investment appraisal because it considers the factor of risk by the means of using discounting rate, or cost of capital or the required rate of return (Slorach, 2000).

Demerits and Limitations of Net Present Value in Investment Appraisal Techniques for Capital Investment Decisions

Net Present Value has the following demerits and limitations regarding investment appraisal:

· Limitation for Mutually Exclusive project

When it is to analyze the investment appraisal of mutually exclusive project, then it becomes difficult to take decision by using NPV as the investments are not equal (Velez-Pareja, 2006).

- Limitation in comparing two projects

When it is to analyze the investment appraisal of comparing different sized of two projects, then it becomes difficult to take decision by using NPV as the size of the NPV output set by the input size (Velez-Pareja, 2006).

· Ignoring Sunk Cost

NPV has the limitation of ignoring sunk cost In capital budgeting like Research and Development Cost. As, these kinds of cost are so huge, then ignoring such kind of cost may not produce an acceptable result and it becomes difficult to accept as well as utilize it the result by corporate finance team (Velez-Pareja, 2006).

· Difficulty in Determining the Required Rate of Return

NPV faces the difficulty of setting the required rate of return because it is used the discounted cost of capital or discounted rate, therefore it becomes difficult to accept as well as utilize it the result by corporate finance team. It is always recommended not to use WACC while calculating NPV with the required rate of return and therefore this wrong estimation produce wring result of NPV (Velez-Pareja, 2006).

Internal Rate of Return

Internal Rate of Return is the most popular techniques in decision making purpose of investment. It is the concept of considering discount rate where the result of NPV-Net Present Value is equals to zero, or remains zero (Block, 2019).

IRR-Internal rate of return is also recognized as DCF-Discounted Cash Flow Technique and it is interrelated with time value of money.

The Formula of Internal Rate of Return as follows:

There have no specific formula of IRR, rather it is calculated by Trial and Error method formula as follows:

IRR = LR + x (HR-LR)

Here,

LR = It is the Lower Rate of assuming cost of capital for calculating NPV

HR = It is the Higher Rate of assuming cost of capital for calculating NPV

Decision Criteria

It is recommended that Internal Rate of Return must be greater than the Cost of Capital.

- So, if the calculated result of Internal Rate of Return is greater than Cost of Capital, then it is decided to accept the project investment (Bierman and Smidt, 2007).

- Again, if the calculated result of Internal Rate of Return is smaller or lower than the Cost of Capital, then it is decided to reject the project investment (Bierman and Smidt, 2007).

- Moreover, if the calculated result of Internal Rate of Return becomes Cost of Capital, then the investment appraisal decision will be neutral whether the overall techniques of capital budgeting could be utilized for decision making purpose (Bierman and Smidt, 2007).

Merits of Internal Rate of Return in Investment Appraisal Techniques for Capital Investment Decisions

Internal rate of Return has the following benefits regarding investment appraisal:

- The main advantage of using IRR in investment appraisal is that allows the time value of money because time value money consideration is important to get the result viable or decision making purpose of investment as of it is known to all that the value of money today is not similar to the next day money value (Watson and Head, 2019).

- IRR is able to present the true scenario of project’s profitability as it covers the project’s economic life entirely (Watson and Head, 2019).

- IRR considers the project’s total cash inflow and project’s total out flows therefore it helps to meet up the objective of maximizing shareholder’s wealth (Watson and Head, 2019).

Demerits and Limitations of Internal rate of Return in Investment Appraisal Techniques for Capital Investment Decisions

· Ignores Size of Project

The limitation of IRR is of size of ignoring the size of the project whereas when the project size are not evaluated then it becomes difficult to consider the generation of cash flows whether the capital outlay is of longer project having lower IRR but smaller project having higher IRR (Wilkes, Samuels and Greenfield, 2006).

· Ignores Future Costs

The limitation of IRR is of size of ignoring future costs whereas the result may affect profit. For example, maintenance costs are the cost of future cost, and when this kind of costs are not considering then the ultimate result of profit could not be evaluated as it is a huge cost for a particular period of time (Wilkes, Samuels and Greenfield, 2006).

· Ignores Reinvestment Rates

The limitation of IRR is of size of ignoring reinvestment rates whereas it is not logical to avoid the reinvestment rate as of project must have cash inflows in future, then it would be reinvested for the expansion of the business (Wilkes, Samuels and Greenfield, 2006).

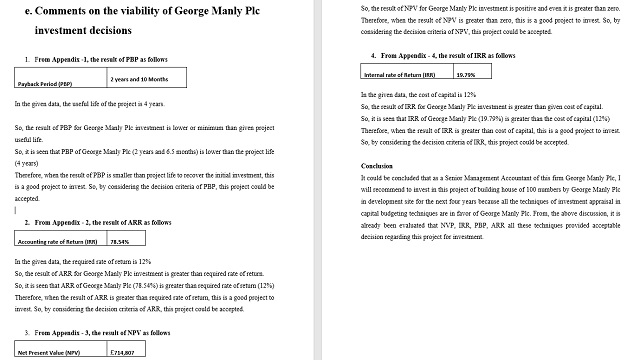

Comments on the viability of George Manly Plc investment

- From Appendix -1, the result of PBP as follows

| Payback Period (PBP) |

2 years and 10 Months |

In the given data, the useful life of the project is 4 years.

So, the result of PBP for George Manly Plc investment is lower or minimum than given project useful life.

So, it is seen that PBP of George Manly Plc (2 years and 6.5 months) is lower than the project life (4 years)

Therefore, when the result of PBP is smaller than project life to recover the initial investment, this is a good project to invest. So, by considering the decision criteria of PBP, this project could be accepted.

- From Appendix – 2, the result of ARR as follows

| Accounting rate of Return (ARR) | 78.54% |

In the given data, the required rate of return is 12%

So, the result of ARR for George Manly Plc investment is greater than required rate of return.

So, it is seen that ARR of George Manly Plc (78.54%) is greater than required rate of return (12%)

Therefore, when the result of ARR is greater than required rate of return, this is a good project to invest. So, by considering the decision criteria of ARR, this project could be accepted.

- From Appendix – 3, the result of NPV as follows

| Net Present Value (NPV) | £714,807 |

So, the result of NPV for George Manly Plc investment is positive and even it is greater than zero.

Therefore, when the result of NPV is greater than zero, this is a good project to invest. So, by considering the decision criteria of NPV, this project could be accepted.

- From Appendix – 4, the result of IRR as follows

| Internal rate of Return (IRR) | 19.79% |

In the given data, the cost of capital is 12%

So, the result of IRR for George Manly Plc investment is greater than given cost of capital.

So, it is seen that IRR of George Manly Plc (19.79%) is greater than the cost of capital (12%)

Therefore, when the result of IRR is greater than cost of capital, this is a good project to invest. So, by considering the decision criteria of IRR, this project could be accepted.

Conclusion

It could be concluded that as a Senior Management Accountant of this firm George Manly Plc, I will recommend to invest in this project of building house of 100 numbers by George Manly Plc in development site for the next four years because all the techniques of investment appraisal in capital budgeting techniques are in favor of George Manly Plc. From, the above discussion, it is already been evaluated that NVP, IRR, PBP, ARR all these techniques provided acceptable decision regarding this project for investment.

References

Bierman, H. and Smidt, S. (2007). The capital budgeting decision. 4th ed. New York: Routledge.

Block, S. (2019). Foundations of financial management. 1st ed. New York: McGraw-Hill.

Foerster, S. (2015). Financial Management. 2nd ed. Welwyn Garden City: Pearson Education UK.

Mukherjee, T. (2008). THE CAPITAL BUDGETING PROCESS OF LARGE U.S. FIRMS; AN ANALYSIS OF CAPITAL BUDGETING MANUALS. Managerial Finance, 14(2/3), pp.28-35.

Oldcorn, R. and Parker, D. (2006). The strategic investment decision. 8th ed. London: Pitman Pub.

Peterson, P. and Fabozzi, F. (2002). Capital budgeting. 2nd ed. New York, NY: Wiley.

Slorach, S. (2000). Corporate finance. 3rd ed. London: Blackstone.

Velez-Pareja, I. (2006). 3 Decision Methods: Npv, Irr and Others. SSRN Electronic Journal, 4(1), pp.62-69.

Watson, D. and Head, A. (2019). Corporate Finance. 1st ed. Harlow, United Kingdom: Pearson Education Canada.

Wilkes, F., Samuels, J. and Greenfield, S. (2006). Investment decision making in UK manufacturing industry. Management Decision, 34(4), pp.62-71.

Appendix

Appendix-1

| Payback period | ||||

| Year | Cash flow | Remaining | ||

| 0 | 4,000,000 | 4000000 | ||

| 1 | £1,050,000 | £2,950,000 | ||

| 2 | £1,712,000 | £1,238,000 | ||

| 3 | £2,277,713 | (£1,039,713) | ||

| 4 | £1,243,650 | |||

| Payback period | 2 years and 10 months | |||

PBP = 2 + [(1039713 / 1243650) *12]

= 2 Years and 10 Months

Appendix-2

| Accounting Rate of Return | ||

| Year | Cash flow | |

| 1 | £1,050,000 | |

| 2 | £1,712,000 | |

| 3 | £2,277,713 | |

| 4 | £1,243,650 | |

| Average Profit = | 1570840.70 | or sum cash flow/4 years | £6,283,363 | /4= £1,570,841 | |

| Average investment= | (initial investment + scrap value)/2 | 2,000,000 | |||

| ARR = | average profit(cash flow in our case)/ average investment*100%= | 78.54203516 | % | ||

Appendix-3

| NPV | |||||

| Year | 0 | 1 | 2 | 3 | 4 |

| Capital expenditure | – 4,000,000 | ||||

| Sales | 5,450,000 | 7,004,000 | 8,752,425 | 6,829,544 | |

| Variable cost | 2,900,000 | 3,762,000 | 4,914,113 | 3,994,081 | |

| Fixed cost | 1,500,000 | 1,530,000 | 1,560,600 | 1,591,812 | |

| Net Cash flow | – 4,000,000 | 1,050,000 | 1,712,000 | 2,277,713 | 1,243,650 |

| Discount factor (12%) | 1 | 0.893 | 0.797 | 0.712 | 0.636 |

| DCF | – 4,000,000 | 937,650 | 1,364,464 | 1,621,731 | 790,962 |

| PV | 4,714,807 | ||||

| Net Present Value(NPV) | 714,807 | ||||

Appendix-4

| Internal Rate of Return | |||||

| Year | 0 | 1 | 2 | 3 | 4 |

| Capital expenditure | – 4,000,000 | ||||

| Sales | 5,450,000 | 7,004,000 | 8,752,425 | 6,829,544 | |

| Variable cost | 2,900,000 | 3,762,000 | 4,914,113 | 3,994,081 | |

| Fixed cost | 1,500,000 | 1,530,000 | 1,560,600 | 1,591,812 | |

| Net Cash flow | – 4,000,000 | 1,050,000 | 1,712,000 | 2,277,713 | 1,243,650 |

| Discount factor (20%) | 1 | 0.833 | 0.694 | 0.579 | 0.482 |

| DCF | – 4,000,000 | 874,650 | 1,188,128 | 1,318,796 | 599,439 |

| PV | 3,981,013 | ||||

| Net Present Value(NPV)(Profit) | – 18,987 | ||||

| so our IRR where NPV =0 should be between 12% and 20 % | |||||

| however we have to calculate exactly | |||||

| IRR = LDR +( HNPV/ HNPV-LNPV)* (HDR-LDR) | |||||

| LDR = low discount factor | |||||

| HDR= high discount factor | |||||

| HNPV =high NPV | |||||

| LNPV = low NPV | |||||

| IRR= 12 + (714,807/ 713,807-(-18,978))* (20-12) | 19.79% | ||||

Written by

Email: [email protected]