CAPM Testing

In this article, we will show you details of CAPM Testing

1.0 Introduction

Determining the expected return price or stock for stocks is important for investors and financial managers. Assessments are needed to decide on investments and evaluate the results of assets. The decision to invest in the financial sector to move into a limited company or another, as in the case of company-based access to the necessary data to reduce the level of the project. The expected return role is essential to determine the future direction of investing in cash to support the decision-making process. With the development of the modern theories of the capital happened in the capital city capitals (CAPM) that support investor contrarian ratings. This theory is based on the successful hypothesis of the market and the key portfolio of effective and significant portfolio outcomes from CAPM, acute development (1964), Lintner (1965) and Mossin (1966). CAPM is used to measure the risk of investment flows and to estimate the value of the project. Administrators are interested in knowing the speed of launching a special investment, and CAPM serves this specific goal. CAPM indicates that the expectation for linear assets is based on riskless risk, systemic risk known as beta and high risk. Describes the CAPM concept based on the principle that the shareholders are rewarded in two ways. Time value of interest rates and market risk. This model provides an assessment of the financial assets on the market while taking into account investor behavior. Beta Risk Measure explains the relationship between the movement of wealth and wealth on the market. The “beta” factor is greater than 1 means that the return on assets has changed dramatically and is expected to outpace the return on the market, while the market price of one of these tests. This model is used to evaluate the processes of mutual funds and other listings and is still important for all major financial books. It is also interesting to analyze how CAPM, as in our case, is an emerging market in London. The goal of each shareholder is to create the GSC to create the best possible return, indicating the risk, which is likely to be minimal for its stock. Relations between risk and return are recognized. Financing refers to the risk that the probability of return on the asset will differ from the expected return on the asset by the broker. This leads to the loss of all assets or assets at the same time if the shareholders’ discretion is wrong. Shareholders, theorists, and individuals can determine their share according to his ability, even if other shareholders are afraid to take important decisions because you lost your property. This creates a need to understand the relationship between risks and returns, especially return on assets. Reliable measures to measure risk/risk and prepare security costs are an essential element of the project CAPM, which aims to evaluate unexpected returns on asset prices.

The purpose of this thesis is to test the value of capital assets in Pakistan’s developing markets. CAPM has been widely tested in financial markets in London. In addition, this study is among the few, if not the first, London Stock Exchange (FTSE-100). The London Stock Exchange is renowned for the strongest liquidity market and investors are exposed to extra risks. As the use of CAPM is still in force and investment decisions, our findings will be of interest to those who have participated in these two areas.

2.0 Literature Review

Hussein and Islam (2017), “Is the Model for Cost of Capital Capital Proper in the Indian Context?” In this research, they examined India’s validity of CAPM 63, listed on the national stock market from 2003 to 2015, as they were used in the Fama and McBeth model and developed four hypotheses. They use the regression from the time series for the beta tables. They concluded that their results showed a link between beta and risk, which was why they eventually came to the conclusion that CAPM was not changing the national income from 2003, a year-to-year basis. 2015.

Gahe et al. (2017), “Evaluation of the Asset Value of the Assets of the Monetary Fund and the European Union: The Case of Ivory Coast Registration,” which clearly states the validity of the CAPM for the economy and the currency of the African Union. This. At the west end of the database is listed in IVOIRE. They are divided into two parts of the middle and second periodic regression. They use some statistical parameters to check that the hypothesis is denied. The results showed that there was no relationship between high risk and high returns. And some hypotheses do not yield the best results.

Afeif (2017), “Appraisal of Capital Patterns and Capital Assets Patterns: Evidence from the United States”, shows the impact of the share and return of the beta market. Researchers hired Amazon firms to be included in the S & P 500’s eight-year profit (2009 to 2016). The researchers recruited some regression models to test various variables. He encountered three hypotheses hypothesis that the hypothesis was rejected and accepted the hypothesis instead. These results show significant results, and CAPM can provide effective market and company efficiencies.

Tishji (2017) “The value of a non-linear asset” The case of Japanese automakers” in the CAPM automotive industry investigation and Suzuki Toyota, Nissan, Mazda, Mitsubishi Honda Motor Corporation and monthly data from 1989 to 2017 if the distribution of the return On the stockpile is a fat CAPM has an excessive effect. If the return of normal stock is distributed in CAP M is too effective The next step is to test the Wald test, it is our straight CAPM and CAPM, if the potential equity analysis is fat tail and the Wald test is to evaluate the possible CAPM. Reliable Linear CAPM, Nonlinear.

Alqisie and Alqurran (2016), “Validity of CAPM” (Evidence of Change on the Stock Exchange of Amman). “This study shows the validity of the CAPM market in Amman collected during the year. Now From 2010 to 2014, this period is divided into three sub-periods. They use 60 shares on the Jordanian Stock Exchange-listed on the Amman Stock Exchange. This analysis is carried out by applying to pipes – test beta, beta, non-linear coefficients, and a hypothesis test. The results of the analysis showed that high risk was not associated with a high rate of return. The beta factor is the best tool to check the relationship between risk and return. Baudry draws disadvantage, so three subordinates are important. Checking to verify nonlinear communication between beta and flipping the CAPM hypothesis cannot find the best evidence to support the CAPM market in Amman.

Abusharbeh (2016), “Understanding the Values of Capital Assets Fama’s Wealthy Asset: Evidence From the Palestinian Market” describes the relationship between risk and the return of a quoted company on the Palestinian stock market. Were awarded 49 for the period from 2010 to 2014. They measure the non-returnable and beta CAPM risk. Return of specific stock is allocated for a whole month. OLS is a new method of estimating a new barrier in a linear regression pattern. They use the method of MacBeth and Sharp. Beta is an individual stock measure. The study also uses CAPM as a robust method (1964). Therefore, the risk of the system (beta) of different shares and beta coefficients is calculated for the period of creation. The regression analysis used in return and market share to determine the probability coefficient for each stock. Also tested the descriptive statistics. The author found that CAPM was not for PEX.

Kapil and Sakshi (2013). “Sample Price Testing of Capital Assets: Evidence from the Indian Stock Exchange.” The author examined the validity of CAPM for the Indian Stock Exchange. Both authors used a 278-page monthly stock index, indexed on the Mumbai Stock Exchange (BSE), which ranged from 500 years 1996 to 2009 from studies that generally found high beta and higher income. This study is based on the hypothesis. Beta multiplier probability of the interval of relations between the beta and the return in this situation and the beta relationships are to be returned in line. Beta is calculated by the regression of each monthly return on the index of the market. Beta is not enough to complete an expected return on securities. The results show that the remaining risk does not affect the return on the portfolio. The results of this study are very useful for Indian stock markets.

3.0 Methodology

Initially, this study checked the accuracy of the CAPM. This chapter focuses on different steps such as technique, selection, model, research, and more. The research is based on OLS wealth. OLS is used to change variables and search data. And the OLS conclusion is completed in the study. It has been used the Fama and MacBeth methods for this study to test CAPE for LSE. The study is based on the London Stock Exchange, which lists 100 times (FTSE-100) of total 13-year revenue from 2005 to 2017, collected from Yahoo Finance. And the London Stock Exchange. To get better results, daily values are used.

3.1 CAPM Equation

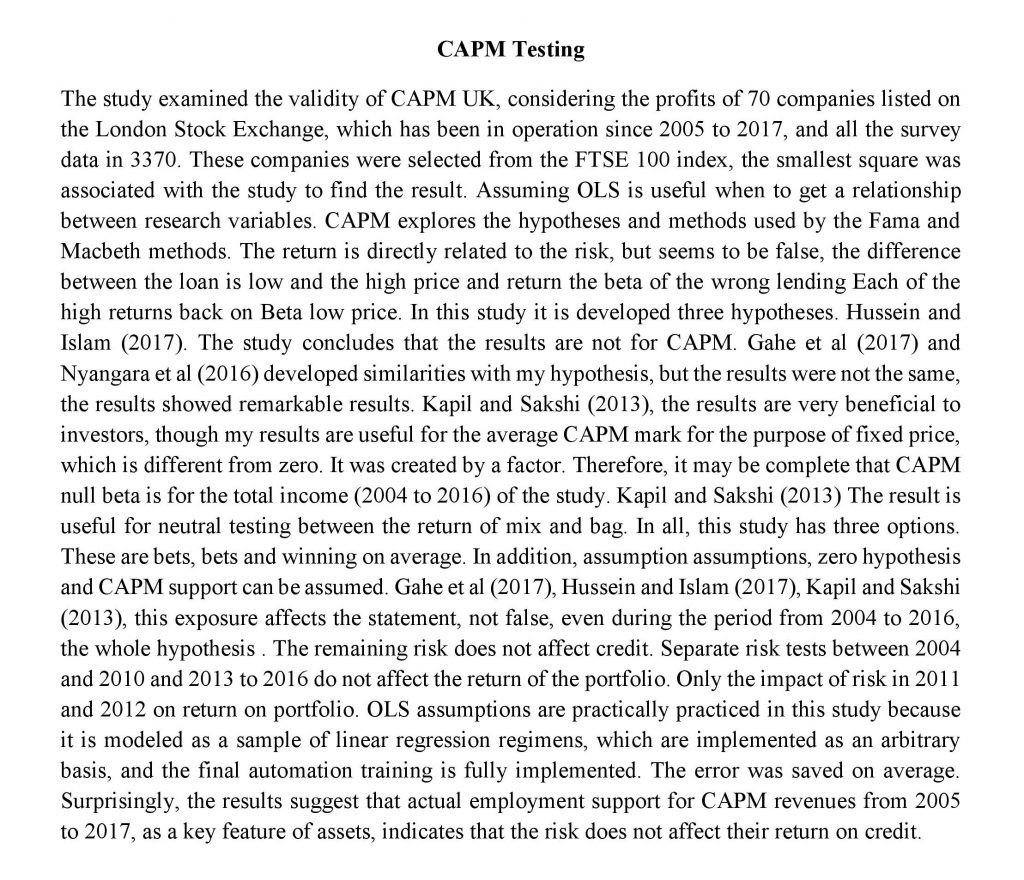

The price model for the original property is referred to as a model of regression of the series value of an equation with mathematics in the form of :

![]()

This study has a sample cost for typical wealth. CAPM has a rate of return, risk, beta and return on the market. Two types of variables are dependent and independent variables.

The Dependent Variable: Return on assets

Independent variables: Interest rates are not at risk (risk of wealth) and return to the market.

Beta Rating:

CAPM testing is a Beta prediction for each quarterly fortune from 2005 to 2017. Regression model using the following sample:

Following beta ratings for each fund, they have been tested for temporary testing and are generally of great importance for the spread of the MS Excel spreadsheet.

Create a Test of the CAPM Test

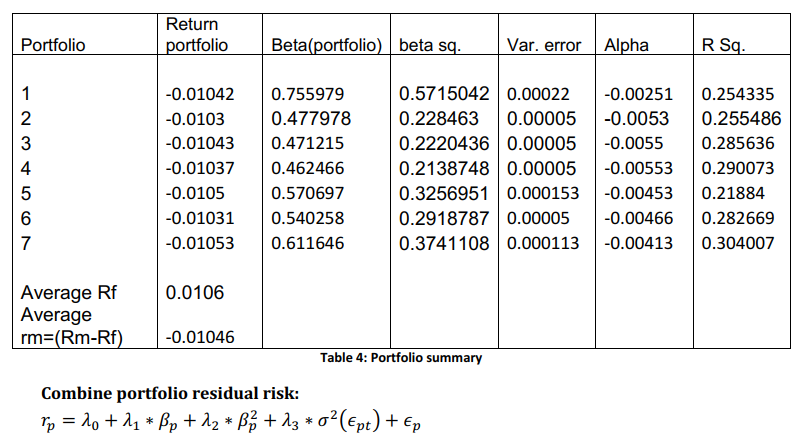

After beta testing and testing, the next step is to create bets based on their beta predictions. That’s why 7 listings with 10 companies were established in all sectors, with the first portfolio with high beta. And so on. The 7th Portfolio has a limited company. The next step in this method is to calculate the average yield of portfolios for which the company’s access is based on the basis of their credit score, the calculation version of the equation (1).

So, therefore the following models are used to calculate the average return on the portfolio:

In that case the to determine the beta of the portfolio the subsequent model may be used as:

![]()

This is explained that the study was seen by Macbeth farmers’ methodology to test CAPM. The CAPM, Fama and Macbeth tests link the portfolio of earnings to a projected surplus of photos by portfolio data regression. The curvature of the curved can be described as the regression of the collected statistical variables in the revolution. This is an idea behind all ratings. Following this approach, which is the next step for this research, is an evaluation of real (small, medium and large) market security for the total income test from 2005 to 2017. Evaluate the portfolio in the equation (4) by using a sample:

![]()

In addition to confirmation and promotion, confirm that if eq (5) relates to CAPM, the market SML line is a CAPM chart. CAPM is marked by:

![]()

Before it becomes clear, this means that the ratio is risk-free and means the amount of risk insurance for the market value of an investment company or risk. This article focuses on this non-linear portfolio between income and loan portfolio (calculated at equal cost (4)) to ensure that it is determined by the average return of the portfolio of this:

![]()

The final analysis of the study, if an unexpected potential company returns a property or portfolio will be treated with market risk and excluding certain risks. To test this template:

![]()

3.2 Hypothesis

3.3 Theoretical framework

In 1952, Harry Markowitz modeled for MPT as Modern Portfolio Theory. Theoretically given the ground to describe and cover the investment risk and to create a link between the fund’s risk and the expected return on the stock. The perception of “diversification” and its measurable performance as link or covariance is the main idea of the MTR. This concept of diversification is useful for the frequency of investment. So Harry Markowitz announced the father of MPT as Modern Portfolio Theory. The main idea of MPT as Modern Portfolio Theory is:

The Effective Market Hypothesis (EMH) states that stock prices contain all information (internal or public). EMX has three forms: the semi-solid and healthy form of effective marketing hypothesis.

EMH as Effective Market Hypothesis weak form: The price covers the material around the foundation on the market

EMH as Effective Market Hypothesis Semi Strong form: Personal values are adapted to the original public material for this fund on the market

EMH as Effective Market Hypothesis strong form: Cost covers the entire repository. New engagement of the amount of evidence leads to real change before it is united.

4.0 Empirical Evidence

4.1 Each Company Beta Estimation

This is the first phase of the beta assay valuation for each company, with a slump in revenues from 2004 on a daily basis in 2016. Beta is calculated from the regression of each company daily to fund the fund. 100 Temporary Financial Markets Index, according to CAPM:

![]()

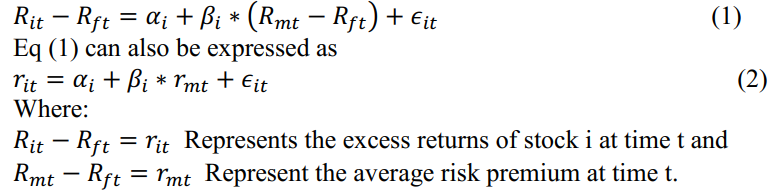

The first step in this research is the beta calculation for each company. All company stock prices have been adjusted to close the prices, and then each of them has reduced the risk for the CAPM approach. The calculated data is that the maximum bet for each stock is 1.09 to a minimum of 0.05 for the period.

4.2 Normality Test for Beta distribution Estimation

After a good evaluation, they were questioned about their validity and validity. Summary of statistics for this description is calculated by adding SPSS data, and the results are shown in the table below:

In this summary, this is to find average as mean mode, the standard errors of the mean, variance, standard deviation, Kusrtosis, skewness, the range of the minimum data and the maximum total amount of data. All prices are calculated by the company beta.

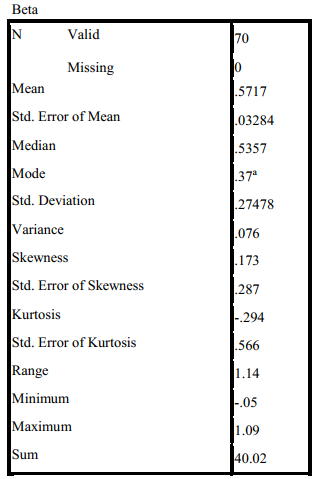

JB testing has free Chi-square distribution with 2D and 2% freedom. The false hypothesis for JB testing is that data is from a normal distribution. The estimated value of the Jarque-Barra test is 0.61267 for beta less than 5.99.

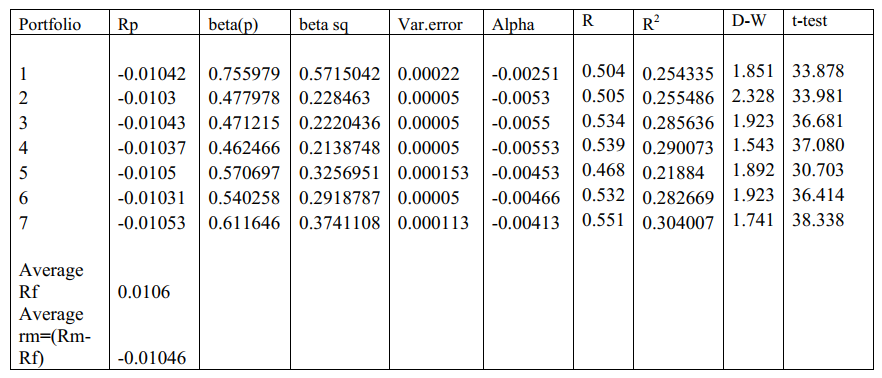

4.3 Portfolio Analysis and Correlation

In the table above R, R2, Beta, Durbin-Watson, et al. Calculated using regression model and multiplier. All R2 values are normal. Durbin-Watson’s value is about 1.5 to 2.5. Data is not sent automatically. All portfolio tests were tested positive with Dependent Reliance and gave positive results.

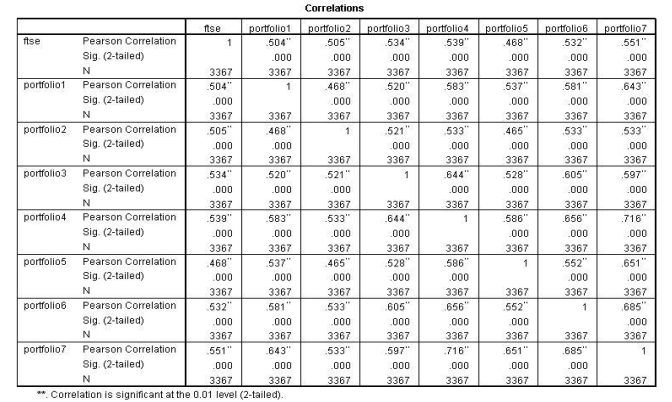

4.4 Correlation Test of all Portfolio

Finding contacts is determined by the matrix form. This study has created a link to a variable. Pearson Connected 0.504 Portfolio 1 The Importance of FTSE Capital The positive outlook as positively significance is 1. Although Pearson’s credit rating of 2, 3, 4, 5, 6 and 7 Pearson has been at 0.50, 0.53, 0.53, 0.46, 0.532 and 0.55 respectively. Regardless of the investment, the FTSE Stock Exchange is worth 1 indicates that all outstanding loans with shares in FTSE from 2005 to 2017

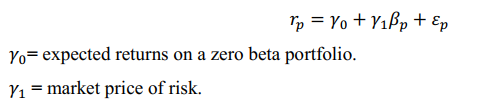

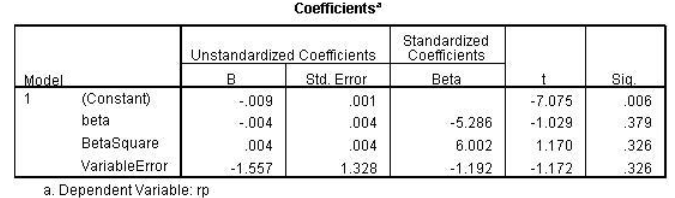

4.5 Final CAPM Testing

The equation for testing CAPM will be

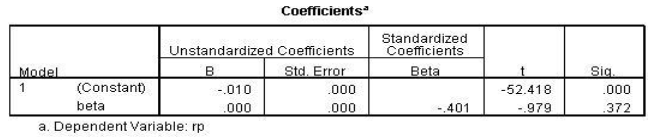

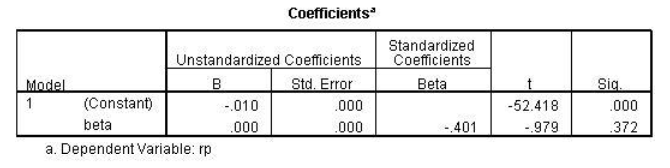

Y0 and Y1 are the differences between the zero beta portfolio and return on the stock market. Only a method that allows the probability of capital asset value is not perfect then adds a market security assessment tool when the CAPM predicts that technology is zero for each property. So this is tried the hypothesis.

Hypothesis Test 1

SML-Security Market Line Intercepting Test

According to CAPM, the base Y0 should be zero. The unstandardized Coefficients value 0.010 is smaller, but the value should be zero, while the total value of the t-test is 52,418. The value is greater than the actual value of 2, 4, by the confidence interval 95% of the 2 tail test.

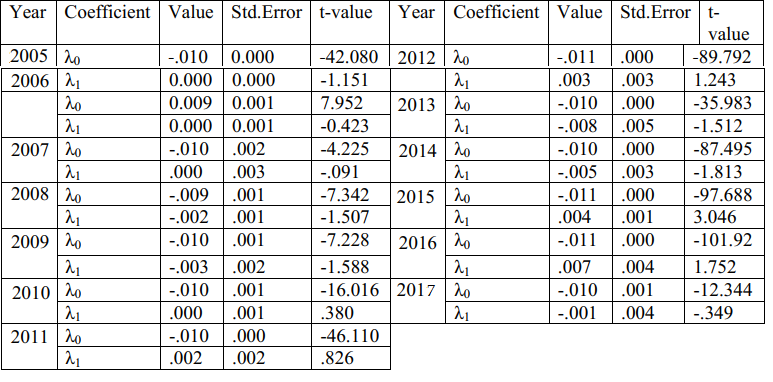

Testing the SML intercepts on yearly data

Testing of SML intercepts on yearly data:

Period 2005

In this table, focal points have been set. The price of the test differs from 1.96. This shows that the slope of SML is important from zero. Although the T-test differs from λ1 (beta calculation) less than the voltage that is important for testing at 1.96. Prices in 2014 differed from last year. The conclusion of the hypothesis was in 2005 to 2017 FTSE is not for CAPM hypotheses.

Hypothesis Test 2nd

Security Market Line Slope Testing:

In addition, the expected price is 0,000 at T-0.9794, which is not over two, which means less impact than zero Beta. So, this hypothesis shows the negative relationship between risk and expenditures in the FTSE 100 survey from 2005 to 2017, assuming the zero or null hypothesis.

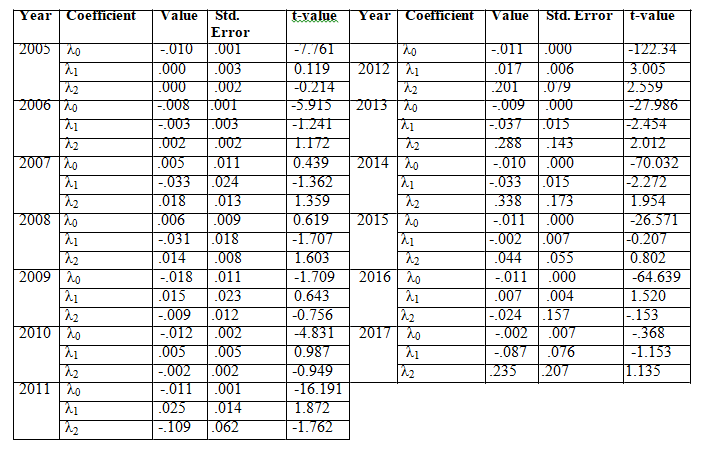

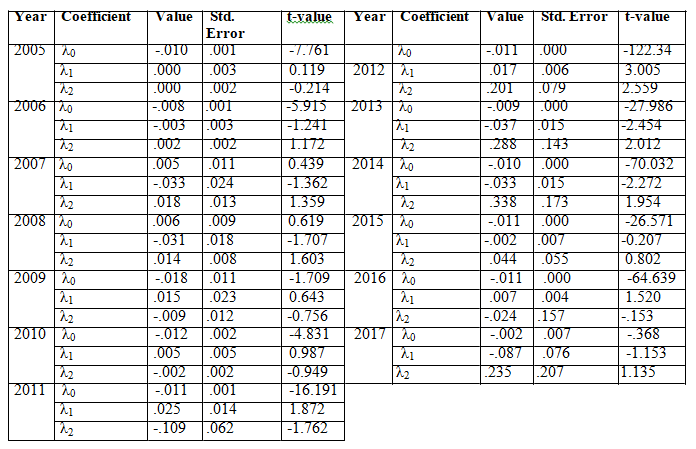

Non-linearity testing for the yearly base:

For assistance from 2005 to 2017, beta and wallets were returned to test the linear axis. Try the regression from the sample, which includes the average return of the beta, wallet and square beta that is also set in this part of the way. Tests abroad are available in the table below.

Period 2005

Above the table is an opaque test table that indicates that the first bet is the second beta and the first bet. Beta zero sets the test price T-7.761 at 1.96, so hypotheses are denied. Beta4, a beta estimate, sets test values t – 0.119, which is low and has a slope of 1.96 from zero. This line is against CAPM. An unprecedented low-cost test in the core area of 1.96, so it is important to zero and is included by CAPM, which is a risk that could affect returns on the portfolio.

Period 2006

Fixed Static Fixed Stations Fixed Costs Exceed Main Value of 5.915 Over 1.96 Indicating the CAPM Concept is Inappropriate. Beta-beta testing is the key value. When this kind of result occurs, CAPM replaces the result. Square Beta for Test Price for 2005 is 1.172 Small. 1.96 Its average value is the square bet number is not significant with zero. The conclusion is that the risk does not affect the return on the portfolio.

Period 2007

The voltage λ0 is reduced because the calculated voltage is 0.439 which is too low for demand. That is why CAPM accepts this calculation. And it is possible that there is no tension. The beta of 2007 of 1.36, which is less than 1.96, assumed that the 2007 CAPM beta test sample of 1.35 points was small, due to its significant value of 1.96 important and not suitable for return.

Period 2008

Calculating the t-0.619 value is a small value, so the CAPM hypothesis is suggested. Estimated The Patent 2008 is 1.707. Low price 1.96 shows that the gradient is minimal. It is completely against CAPM. The estimated market value is 1,603 λ2 1.96 because the base price does not meet CAPM requirements and concludes that the risk is not the return of the wallet.

Period 2009

The test value of 1.709 is the most important, so the CAPM hypothesis is decent. The T-TEST estimate for 2009 is 0.643b above 1.96, indicating that the slope is essential from zero. This calculation is against CAPM. The expected value of λ2 0.756 is less than 1.96. λ2 indicates that the result is not significant because of the CAPM hypothesis that does not affect the return of the portfolio.

Period 2010

Constants λ0 show primary output zero. T Tester 4.831 is higher than their baseline. The result indicates that it overrides the state and does not flip the line without a line in the wallet. Beta 2010 has been rated beta with its test price of 0.987, which is less than 1.96. The conclusion of the results is insufficient and insufficient for the value model of the asset. BETA 2010 Calculator T is 0.949, which is too low for a base value of 1.96. It shows insufficient results and the risk of return on the portfolio is not affected.

Period 2011

λ0 indicates that it differs from zero. The T-test value is 16.19, higher than the base price of 1.96. The final result is a non-linear CAPM denial. The Beta-2011 beta was 1.87 and its value was small. The conclusion of that statement is not enough from zero. This is contrary to the capital cost model of capital assets. The T-Beta square test, calculated in 2011, is 1.76 inches. Its main value is 1.96. Beta 2011 is negligible. This is a good result and the risk of portfolio return is ineffective.

Period 2012

λ0 is estimated to be stable for tests worth more than the base value of 1.96. Displays the results that refuse the CAPM data, which may be non-linear. The calculated T of beta 2012 is 3.005 which is higher than 1.96. Conclusion The result is a lot of zero. CAPM supports this model. The calculated value for the T-square in 2012 is Beta 2.559. It is above 1.96, so it is important.

Period 2013

The capture λ0 is strongly changed from zero. The T-test test was estimated at 27,986 above 1.96. This is against CAPM. Estimated Beta testing value is 2,454, higher than the key value of 1.96, which is supported by CAPM t-value of λ2 2.012 is higher than the base value of 1.96 and λ2 is zero zeros. Impact of risk on the return of a portfolio.

Period 2014

Set λ0 indicates significant changes from zero. The test value of T is 70,032 with 1.96. CAPM hypotheses deny this. The cost calculation for 2013 is 2.272 beta, with a key value of 1.96. This evidence supports CAPM. The calculation value of test B-test is 1.954, the minimum curve is 1.96. So the result is negligent from zero.

Period 2015

The constant λ0 is strong from zero. The development of this model is a test value of T-26,571 which is high 1.96. Therefore, CAPM rejects this calculation. T-shirts for 2015 are 0,207 beta, less than 1.96. This calculation is not sufficient for CAPM. Then – the expected value of 0.802 λ2 is less than 1.96 so λ2 is zero, the value, and it is always a CAPM hypothesis. They concluded that the incident did not affect the return of the portfolio.

Period 2016

The constant λ0 indicates that it is zero. The price of the T-test is 64,639 which is a great value. Conclusion The result was not for CAPM. And there is no link that cannot be found in the data. The test value calculated in 2016 of 1,520 kilograms. For the main price of 1.96. The problem of refining the environment is not enough. It is not a CAPM. Beta Set 2015 The T-Test Portfolio is 0.133 less than the Main Value. The conclusion of the test is not enough. This risk is not related to the return of the portfolio.

Period 2017

λ0 the fixed value differs slightly from zero. The value of the test is 0.368, not its small value of 1.96. CAPM accepts this result. The calculated T-test value is less than in 1153 as 1.96, indicating that the slope is important from zero. The conclusion of this order is against the CAPM. The assumed value of λ2 1.135 is minus 1.96, square bet 2017 is no more than zero. The risk is the independence of the return on the portfolio.

Testing for Nonlinear: Basic testing that creates a relationship between beta and backpack. This section is calculated from central regression, beta, and beta packages. The next model is a linear, nonlinear test. To test the capture results, it is very important. But the study of the slope of the security market and the return of the nonlinear line is not important. Therefore, the conclusion of this section is the support of CAPM.

Hypothesis test 3

Residuals risk testing: In CAPM’s opinion, the return on the stock is different from the beta and the remaining risks do not affect the company’s return. For top-line tests, this phenomenon is the residual variation in beta and square bags.

Separate Portfolio Test drive:

Testing is at the top of the head. The content of the portfolio is shown in the table below

The result shows that the variable error that is estimated of the unstandardized coefficient is 1.557 as from the variable error of t-test value 1.172 which is small the critical value of 2.

Hypothesis testing

Hypothesis 1

H0 = There is a subtle relationship between the beta portfolio and the expected return.

| Time Frame | Results of Data | Testing of Data |

| 2005-2017 | The Results is Significant | Rejected |

| 2005 | The Results is Significant | Rejected |

| 2006 | The Results is Significant | Rejected |

| 2007 | The Results is Significant | Rejected |

| 2008 | The Results is Significant | Rejected |

| 2009 | The Results is Significant | Rejected |

| 2010 | The Results is Significant | Rejected |

| 2011 | The Results is Significant | Rejected |

| 2012 | The Results is Significant | Rejected |

| 2013 | The Results is Significant | Rejected |

| 2014 | The Results is Significant | Rejected |

| 2015 | The Results is Significant | Rejected |

| 2016 | The Results is Significant | Rejected |

| 2017 | The Results is Significant | Rejected |

The result above shows that the null hypothesis is rejected.

Hypothesis 2

H0 = There is a negligible relationship between beta, beta portfolio, and expectations.

| Time Frame | Results of Data | Testing of Data |

| 2005-2017 | The Results is Insignificant | Accepted |

| 2005 | The Results is Insignificant | Accepted |

| 2006 | The Results is Insignificant | Accepted |

| 2007 | The Results is Insignificant | Accepted |

| 2008 | The Results is Insignificant | Accepted |

| 2009 | The Results is Insignificant | Accepted |

| 2010 | The Results is Insignificant | Accepted |

| 2011 | The Results is Insignificant | Accepted |

| 2012 | The Results is Significant | Rejected |

| 2013 | The Results is Significant | Rejected |

| 2014 | The Results is Significant | Rejected |

| 2015 | The Results is Insignificant | Accepted |

| 2016 | The Results is Insignificant | Accepted |

| 2017 | The Results is Insignificant | Accepted |

The table above shows the hypothetical experiments that conflict with the CAPM table showing a lesser number of results. Only 2012-2014 supports the theories of CAPM.

Hypothesis 3

H0 = The remaining risk does not affect the return of the portfolio.

| Time Frame | Results of Data | Testing of Data |

| 2005-2017 | The Results is Insignificant | Accepted |

| 2005 | The Results is Insignificant | Accepted |

| 2006 | The Results is Insignificant | Accepted |

| 2007 | The Results is Insignificant | Accepted |

| 2008 | The Results is Insignificant | Accepted |

| 2009 | The Results is Insignificant | Accepted |

| 2010 | The Results is Insignificant | Accepted |

| 2011 | The Results is Insignificant | Accepted |

| 2012 | The Results is Significant | Rejected |

| 2013 | The Results is Significant | Rejected |

| 2014 | The Results is Insignificant | Accepted |

| 2015 | The Results is Insignificant | Accepted |

| 2016 | The Results is Insignificant | Accepted |

| 2017 | The Results is Insignificant | Accepted |

From 2005 to 2017, all hypothetical assumptions were assumed that residual risk did not affect credit. Separate risk tests between 2005 and 2011 and 2014 to 2017 do not affect the portfolio. Only the impact of risk in 2012 and 2013 on return on a portfolio.

5.0 Conclusion of CAPM Testing

The study examined the validity of CAPM UK, considering the profits of 70 companies listed on the London Stock Exchange, which has been in operation since 2005 to 2017, and all the survey data in 3370. These companies were selected from the FTSE 100 index, the smallest square was associated with the study to find the result. Assuming OLS is useful when to get a relationship between research variables. CAPM explores the hypotheses and methods used by the Fama and Macbeth methods. The return is directly related to the risk but seems to be false, the difference between the loan is low and the high price and return the beta of the wrong lending Each of the high returns back on Beta low price. In this study, it is developed three hypotheses. Hussein and Islam (2017). The study concludes that the results are not for CAPM. Gahe et al (2017) and Nyangara et al (2016) developed similarities with my hypothesis, but the results were not the same, the results showed remarkable results. Kapil and Sakshi (2013), the results are very beneficial to investors, though my results are useful for the average CAPM mark for the purpose of a fixed price, which is different from zero. It was created by a factor. Therefore, it may be complete that CAPM null beta is for the total income (2004 to 2016) of the study. Kapil and Sakshi (2013) The result is useful for neutral testing between the return of mix and bag. In all, this study has three options. These are bets, bets and winning on average. In addition, assumption assumptions, zero hypotheses, and CAPM support can be assumed. Gahe et al (2017), Hussein and Islam (2017), Kapil and Sakshi (2013), this exposure affects the statement, not false, even during the period from 2004 to 2016, the whole hypothesis. The remaining risk does not affect credit. Separate risk tests between 2004 and 2010 and 2013 to 2016 do not affect the return of the portfolio. Only the impact of risk in 2011 and 2012 on return on a portfolio. OLS assumptions are practically practiced in this study because it is modeled as a sample of linear regression regimens, which are implemented as an arbitrary basis, and the final automation training is fully implemented. The error was saved on average. Surprisingly, the results suggest that actual employment support for CAPM revenues from 2005 to 2017, as a key feature of assets, indicates that the risk does not affect their return on credit.

6.0 References

Al-Afeef, M. (2017). Capital Asset Pricing Model, Theory and Practice. International Journal of Business and Management, 08-12.

Alqurran, A. A. (2016). The validity of Capital Assets Pricing Model (CAPM) (Empirical Evidences from Amman Stock Exchange). Journal of Management Research, 02-16.

Asalya, A. S. (2013). Testing the Capital Asset Pricing Model on the Karachi Stock Exchange. Thesis in Economics, 04-47.

Carmine De Chiara, G. W. (2015). TESTING THE CAPITAL ASSET PRICING MODEL IN THE ITALIAN MARKET. Corporate Ownership & Control, 40-47.

CHOUDHARY, K. (2010). Testing Capital Asset Pricing Model: Empirical Evidences from Indian Equity Market. Eurasian Journal of Business and Economics, 127-138.

Coursera. (2017). Testing the CAPM. Retrieved 08 08, 2018, from Coursera: https://www.coursera.org/lecture/investments-fundamentals/testing-the-capm-h8aGj

Fabinu, M. (2017). An empirical analysis of the capital assets pricing model (CAPM) is a tool for the valuation of a company’s returns. Net Journal of Business Managemen, 30-45.

Gahe, Z. S. (2017). CAPITAL ASSET PRICING MODEL TESTING IN WEST AFRICA. International journal of research granthaalayah, 12-19.

Gaziz, S. (2009). Testing the Capital AssetPricing Model: an econometric Approach. KAZAKHSTAN INSTITUTE OF MANAGEMENT ECONOMICS AND STRATEGIC RESEARCH, 02-16.

György ANDOR, M. O. (1999). EMPIRICAL TESTS OF CAPITAL ASSET PRICING MODEL (CAPM) IN THE HUNGARIAN CAPITAL MARKET. School of Social and Economic Sciences, 02-16.

Hawaldar, I. T. (2015). Empirical Testing of Capital Asset Pricing Model on Bahrain Bourse. Asian Journal of Finance & Accounting, 15-26.

Iliaki, D. (2017). Testing the efficiency of FTSE 100 in the mean standard deviation space. Master of Science (M.Sc) in Banking and Finance, 02-396.

Jamil, A. (2016). TESTING THE VALIDITY OF CAPM: EMPIRICAL EVIDENCES FROM LONDON STOCK EXCHANGE. Research, 02-16.

Md. Zobaer Hasan, A. A. (2011). A Validity Test of Capital Asset Pricing Model for Dhaka Stock Exchange. Journal of Applied Sciences, 3490-3496.

Michailidis, G. (2006). Testing the capital asset pricing model (CAPM): The case of the emerging Greek securities market. International Research Journal of Finance and Economics, 78-91.

Muhammad Ibrahim Khan, M. G. (2012). Assessing and Testing the Capital Asset Pricing Model (CAPM): A Study Involving KSE-Pakistan. Global Journal of Management and Business Research, 01-07.

Nikolaos, L. (2009). An Empirical Evaluation of CAPM’s validity in the British Stock Exchange. Electronics and Computer Engineering, 01-08.

Olakojo, S. (2010). Testing the Capital Asset Pricing Model (CAPM): The Case of the Nigerian Securities Market. International Business Management, 239-242.

Pham, T. T. (2017). Testing the Capital Asset Pricing Model (CAPM) in the Vietnamese stock market: an analysis of two sub-periods from 2006 to 2016. Aalto University, 02-56.

Shaikh, S. A. (2013). Testing Capital Asset Pricing Model on KSE Stocks. Journal of Managerial Sciences, 02-16.

ShwetaBajpai. (2015). An Empirical Testing of Capital Asset Pricing Model in India. Procedia – Social and Behavioral Sciences, 259-265.

Trifan, A. L. (2009). TESTING CAPITAL ASSET PRICING MODEL FOR ROMANIAN CAPITAL MARKET. Annales Universitatis Apulensis Series Oeconomica, 01-09.

Tsuji, C. (2017). A Non-linear Estimation of the Capital Asset Pricing Model: The Case of. Finance and Accounting. Finance and Accounting, 02-16.

Wakyiku, D. (2010). Testing the Capital Asset Pricing Model (CAPM) on the Uganda Stock Exchange. Statistical Finance, 02-16.

WERE, A. (2012). TESTING THE CAPITAL ASSET PRICING MODEL ON RETURNS AT NAIROBI SECURITIES EXCHANGE. MANAGEMENT RESEARCH PROJECT, 02-78.