1.0 Introduction

Corporate Governance is a set of rules and practices that companies use to guide their decisions and actions. As these laws determine the way the company decides to run, the management process has a great impact on the company’s performance. Small businesses using professional principles in the process of Corporate Governance Structure do not always have the highest profit or the highest value of securities and the execution of those who have other advantages. General observers consider stock prices as a measure of company performance. While previous studies have found that there is a positive relationship between corporations and corporate governance, these relationships do not always lead to higher stock prices. In fact, the USC study from financial institutions to financial institutions in 30 countries found that the characteristics of corporate governance were highly emphasized and the independent board of directors was associated with Low performance of the fund during this period. After the financial crisis in 2008, corporate governance can decide that the company is a result of positive environmental activities in 2013, 313 Timetable for the 1997 Management and Management of the Greatest US Environmental Management and Management, From the study examines how the relationship between employers and members of the Board of Directors can determine policies Its environment. He discovered that companies with many CEOs and strong corporate governance are likely to implement and implement policies that mitigate the impact of the environment. Companies often do well with parallel guidelines. When the company changes its control over a short period of time, corporate work is often painful. The study, published in the journal “Corporate Finance” in 2008, was investigated whether the dismissal of managers related to the disciplinary reasons only arises in the company, with the instructions of the poor or for the company. All regardless of the outcome to the survey found that companies with strong corporate governance were less likely to be ruled for disciplinary reasons, though not necessarily represented.

Modern Corporate Governance discusses the theory of agency and theories of corporate management behavior. Agency theories predict a major conflict between shareholders and managers about asset abuse and governance. Agency conflicts can be reduced to the maximum that makes the owner’s manager. Believing that when managers become part of their owners, they will be more accountable for decisions about governance that will generate value for businesses. The relationship between the corporate governance structure and the business outcomes of the company is the subject of strategic interest and strategic debate because of the company’s value and its impact on Management activities. This issue has received much attention in recent years since the fall of Enron, a big program, has collapsed on World.com. There is no general agreement on setting corporate governance, but the goal is to provide a process that can be implemented in an organization to help the company work for its business and accounting growth. In other words, it aims to increase shareholder value in which the organization is managed. Attention and integrity. Since the company’s directors are chosen by the owner to protect the interests of his grandparents, it is necessary to review the structure of the board and other governance regimes that govern. Despite practical evidence of corporate governance in the development market, little attention has been paid to less-developed countries, such as UK. Understand the structure of corporate governance and its implications for corporate performance.

Many researchers have addressed corporate governance issues and their implications for the organization process. For each company, different forms and levels of efficiency, including funding and internal efficiency, are in the process of preparation. There are many cases of company failures that see a big drop in the organization. Given that the leader of this organization is responsible for making decisions about all processes within the organization, its role is most important to improve and maintain this process at In the organization.

2.1 Corporate Governance Guidelines

Due to an analysis of property management, functionalities and governance, and the existence of a gap that leads to the possibility of a major agent conflict, because their managers can benefit from the use of the company’s assets, which are Study of Dangerous or False Plans (Jensen and Meckling, 1976). To resolve disputes at the agency and to determine the cost of the agency for internal and external mechanisms is proposed through this mechanism of corporate governance. Management of the site, including among other things, the Board of Directors, the Board of Directors of the Council and the Audit Committee states that Corporate Governance Management Effectiveness and corporate governance structure is very important as well as Promoting the use of economic resources The biggest technological efficiency levels and help companies and economies to attract capital investment costs by increasing investment and creditor confidence both at home and internationally. They also say that it boosts corporate responsiveness to society’s needs and expectations and promotes long-term business practices.

2.2 Theory of Corporate Governance

Corporate governance theory is an important part of corporate governance and corporate governance structure. Specific measures are based on the theory of relevance. This section will show some key theories that will help us understand the corporate governance mechanism.

2.2.1 Agency Theory

It has shown that the importance of corporate governance as well as corporate governance structure to mitigate corporate and corporate governance conflicts as a mechanism for sustainability of shareholders and management and a definition that is based on the agency’s theories. Jenson and Mekling (1976) explain that an agency may be known as “a contract that meets of liability to engage with some agency operations for providing services on the Internet on “The basis of this question may be in the different interests of the principal and as an agent that violates the expectation that representatives of the interests of the company is not self-employed. The agency’s value is the price corresponding to the difference between the intent of the agent and the customer. For example, shareholders may want to increase their earnings per share by focusing on reducing costs as managers intend to spend more on profits. These different views may lead to additional costs or losses. Jensen and Meckling (1976) think that agency spending is inevitable as the cost of the agency is completely controlled. They also believe that the owner is called to reduce these costs. The Agency’s theoretical focus on how to build a reasonable contractual relationship between the principal and the agents and agencies gives incentives to choose to increase the interests of shareholders and reduce the agency’s costs. At the same time, they claim that decentralization, decision-making, corporate governance structure, and corporate ownership today can reduce the company’s performance and lead to an increase in costs.

The agent’s most prominent issue was the chief problem of an agent set by Ross (1973). This is due to the mismatch between shareholders and managers and the lack of proper oversight. Moreover, if the company is not the manager’s owner, the manager may break up the company’s assets. Many examples are commonly known as Enron. Many analysts believe that Enron’s board failed to fulfill its mandate in managing the company and led the company to start illegal activity. Lack of merger between shareholders and leaders can be the last cause of Aaron’s ending. To address this issue, Jensen and Mekling (1976) tend to be more in control of ownership, which means the company builds relationships between its shareholders and shareholders. For example, providing a unit administrator can increase the number of agents’ benefits that may reduce disputes between agents and shareholders. In addition, the theory of the agent also has an important influence on board composition. Rosenstein and Yuet (1990) argue that good counseling helps shareholders decide to take the initiative by providing useful advice. The correct revision of the council also shows a positive impact on solving problems with key agents.

2.2.2 Resource-dependent theories

The study of the association between the organization and the work of the environmental organization has many different theories, but the most popular is the theory of reading resources. Accepting theory theoretically, no organization can support external life. The environment provides organizations with resources to support jobs, and companies can find more natural resources to protect their interests. The reason that independent organizations rely on each other is that resources are at the core of the strengths and resources of the company, which will likely make the company more special. There is a direct relationship between power and resource dependency. For example, the power of C to J is equated with the resources of J, Pfeffer and Salancik (1978), indicating that the environment is also ending the organization’s understanding of the organization’s behavior. Resource Theorem is widely used in the company’s strategic strategy. The main purpose of this theory is to determine if the company can reduce environmental uncertainties and communicate.

Pfeffer (1987) provides five main points for the expectations of resources and key topics to understand the relationship between business and society as an organization. Secondly, these organizations do not control themselves, but under internal barriers with other organizations. Additionally, the insecurity of NGOs depends on reliance on activities that uncertainty about the need for sustainable success in trade competitiveness. The fierce; Four organizations are taking action to control external reliance, though this inevitable action will not be fully successful and will lead to reliance on new models and independence! These five types of reliability generate energy within and within the organization, and it affects the behavior of the organization. This view and the need for organizations to respond to the outside world occupy the most important positions in organizational theory, corporate governance structure and strategic management.

RTD has a major impact on most critical management mechanisms. Composition of Board of Directors Kaplan and Harrison (1993) argue that the Board’s attention to resource allocation. The council provides resources to support management decisions. Board of Directors’ capital can be understood in a narrow sense as a resource available to the Company. One of the board’s resources is considered a human resource. This includes the resources of the Board of Trustees, which are their personal knowledge, skills and expertise. Another is the capital of the relationship, which means that when members outside the Board of Directors are in good standing, they will provide ways to reduce disputes between shareholders and board of directors. The council has the unique advantages that can help companies understand the company’s external environment and provide more information to help companies reduce uncertainty and reliability. So when the company’s external environment changes drastically, the composition may change depending on the environment. This includes appointing board members and selecting specialists in other regions, depending on the need for other advice firms. Providing sufficient resources to the organization can help the company access (Richard, 2000). The final part of this article will show some theories and practical evidence that the diversity of the board can have a positive impact on the company’s performance. The relationship between corporate governance mechanisms and corporate performance or corporate governance structure Like the variable design, this document will focus on four corporate governance mechanisms (such as connectivity, size, management, advice and advice) and the practices of the three companies, including the use of Ryo and Tobin-Q. Changes and increases in price during this time. In addition, the total assets of the listed company will be used to represent the size of the company

2.3 Management of ownership

To address this issue, Demsetz and Lehn (1985) pointed out that equity of the shareholders can unite the interests of the owners and managers. Many scientists believe that redirecting to shareholders is a long-term motivation that encourages managers to improve performance and bring the company as a shareholder a good result from the company.

Many literature studies have sought agency costs and communication between the assets, operations, and practices of the company. Jensen and Mekling (1976) argued that asset management could reduce agent costs and that such spending would decrease as shareholder participation increased. Based on the study by Jensen and Meckling, Ang et. Al. (2000) investigated and found that the cost of agency agencies with external revenues was higher than the cost of agencies for local agencies and increased expense of agents when foreign equity was high. Biswas and Bhuiyan (2008) stress that ownership of governance is important because it can encourage managers to work responsibly with their possessions.

However, while asset management can have a positive effect on agency savings, its impact on the company’s performance may not be positive. Different scientists have made different conclusions in the field. Even after the company’s investigation, after Athens in Drekos 2000-2004 and Bekiris (2010), found that the company’s positive owner could affect the company’s value. Most literature indicates that there is an impartial relationship between agricultural and business management. In the United States, when the director has less than 40% of Kinton’s worth, the increase in stock price increases. When the capital is between 40% and 50%, the value of Q begins to decrease the increase in the unitary ratio (McConnell and Servaes, 1990). Coles and Al. (2012) supported this finding and found that the impact of ownership over management practice was positive in the eyes of the numbers and was negative after the figures. While BS (2011) explores British organizations and concludes that when the ownership of the company is less than 5% or 15%, the best performing company when the ratio is between 5-15. Corporate Presentations. For example, Dementia and Vilallonga (2001) have concluded that there is no connection between the two countries, although the increase in shareholdings may cause problems with government coordination and resolution depending on the rate Of the returns can compensate for these errors. Also backed by Jahmani and Ansari (2006), they said giving the form as shareholder of the same managerial salary does not affect the company’s incentive.

Language referrals have a number of reductions in existing research. Some researchers strongly believe that corporate governance practices have the potential to increase company performance. Also, some researchers have reason to believe that corporate governance does not always bring better results. Argument for the contradiction indicates that the question of the relationship between corporate governance and the practice of securities firms that are recognized for legal market trading is not discussed in detail. It is clear that Corporate Governance affects the performance of the organization because no one, even the largest company, (Remeboog & Szilagyi, 2015). For the efficient use of corporate governance and corporate governance structure, it is important to understand how and to what extent affecting efficiency. Real-setting processes that directly affect corporate governance will highlight the relationship between governance and efficiency. Additionally, previous surveys do not show the level of investment in corporate governance that impedes or inhibits the organization’s performance. The purpose of this study is to evaluate relationships by measuring the strengths of relationships and practices to ensure that corporate governance enhances the efficiency of the organization.

-

Data Analysis

4.1. Data Research Strategy

This article will use a quantitative method. A survey project is a description or experiment. This study only deals with the relationship between variables. Experiment builds relationships between causes logical analysis. Quantitative research focuses on digital data and changes, and incompatible detailed reasoning. The researcher will use specific indicators to measure the company’s results to examine its relationship with corporate governance mechanisms, an important method of collecting data from the second hand and the annual report of the selected company. The data source for this article is the database. Data stream database and famous database will be used.

Cavana, Delahaye and Sekaran (2001) claim that data collection after processing is processed and must be analyzed in accordance with the plan outlined during the development of the research plan. The research is important and all data are available to compare and analyze. The analysis of this term refers to the calculation of specific measures along with the search for the model of relationships between the data groups. The collected data will be converted into fragments according to the frequency table and will be analyzed using the quantitative technique. To implement this analysis, the researchers will use programs such as MS Excel, SPSS, and other necessary documents.

4.2 Structure of the Data Analysis

The article will select about 500 companies listed in the United Kingdom and will use the data published by these companies in their annual report during a research site. Except deer and deer, or more than 200% of companies that do not show top management, the chosen shares do not match the data. This is the main reason for the company’s choice to be traded on a legitimate market in the UK, that is, the UK’s economic environment is as good as stock exchanges in the United Kingdom, the largest stock market In Europe. Management is also mature. Compared to some developing countries, data is kept much better, more accessible and more standard.

4.3 Variable Data structure

4.3.1 Dependent Data variants

The company’s results are reversible variables that are measured by two portraits: Return on Assets (ROA) and Return to Capital (ROE). Because the accounting measures of both probioty are widely used and generally accepted by researchers in corporate governance, some researchers prefer to use marketing activities. The two measures that represent the different aspects of the evaluation in evaluating the performance of the company are affected by different theories (Hillman and Keim, 2001). These measures are consistent with the survey results of other organizations and are often used by financial analysts, marketing groups and performance evaluation teams (Shrader et al., 1997). The Tobin quiz is used in literature, Proxy’s Corporate Governance measures and corporate governance structure, based on its ability to create wealth for shareholders and to reflect changes and growth within the company’s value at a particular time. The company, in which Tobin’s proportion is more than 1.0, is expected to allow customers to create a bigger value, effective resource, while those with a portion of the Tobin request less than 1.0 are associated with you The ones that use the available resources. In addition, the Tobin Accountability Questionnaire and, unlike the Reserve Bank Assets, can not be reported on violations of the Tax and Accounting Conventions (Lindenberg and Ross, 1981). In particular, the reported financial transactions can change dramatically over a year when the company has canceled its reputation as a buyer. As a result of the event’s accounting, it is possible to give an idea of past outcomes, as this problem, Tobin was expected to focus on the future (Demsetz and Villalonga, 2001). In addition, the total assets of the listed company will be used to represent the size of the company.

4.3.2 Independent Data variables

For independent variables, this document will focus on four corporate governance mechanisms, which include independent rule, size, board composition, board diversity, and asset management. First, the independence of the Board of Trustees is measured by both powers in proportion and driven by an executive failure. The Non-Executive Chairman is measured as a percentage of the Independent Director on the Board’s Performance and this incentive is measured by the average director or monetary compensation, which includes the salary and bonus paid to the Executive Director for one year Second, ownership, as part of the document using the shareholders’ equity of the shareholders of the senior management and the shareholders. The investor represents the management of ownership. Third, as an agent of the diversity of the First Group’s Board of Trustees, use DWOM-1 Petition when at least one woman appears on the board. The second variable is the percentage of women on PWOMEN divided by the number of female directors divided by the total number of directors. Finally, the size of Board of Directors is the number of board members at the end of the year.

4.3.3 Variable Data statistics control

Among the company’s total management variables; it is measured by considering the natural theoretical of gross income each year, generally because of its size not distributed. The senior age is measured by the logarithm of the number of years between the years of compliance and the base year of the company. The frequency of meetings of the council should also be considered when monitoring the variables.

4.3.4 Regression Equation Model

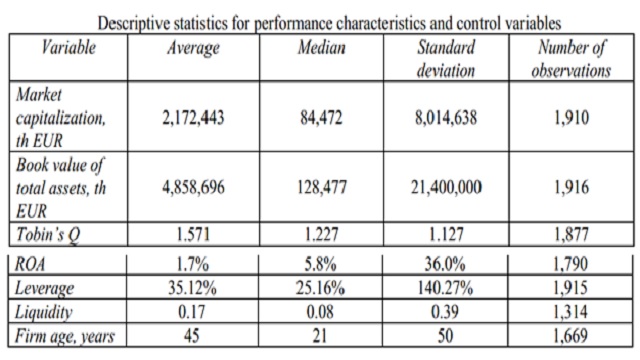

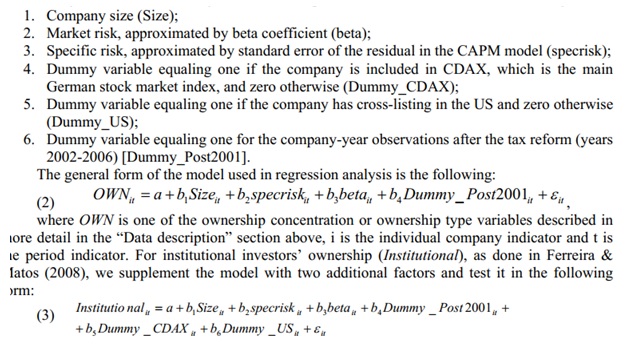

The principal set of speculations tried in this article is figured as far as possession structure determinants. As showed above in the outline of existing experimental research in the field of corporate administration and execution, proprietorship structure ought to be dealt with as a vector of endogenous factors. Accordingly, the initial step of any investigation of the connections between possession structures and friends execution is to locate the exogenous determinants of proprietorship. Following Demsetz and Villalonga (1985) and Ferreira and Matos (2008), we test the effect of a few factors on possession structures. The specifics of the information utilized as a part of the exploration enables us to add one more exogenous factor to possession structures determinants: as the investigation is done on the information on German organizations (2000-2006), for which significant proprietorship reshuffling was the consequence of 2002 expense change, the variable separating pre-change and post-change periods is additionally utilized as a factor in relapses. The subsequent rundown of proprietorship structures determinants is the accompanying:

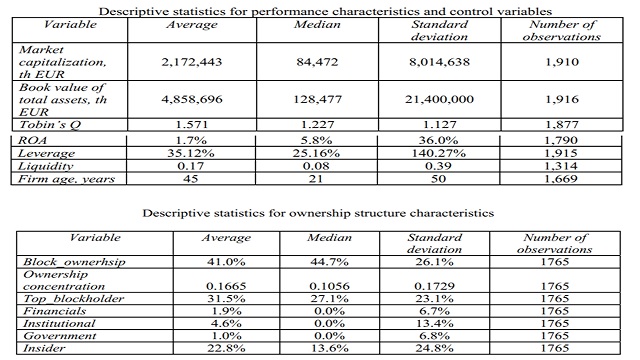

The second set and third arrangements of speculations are planned concerning the connection between possession structures and execution, and board qualities and execution, separately. The effect of possession structure along with corporate governance structure and board qualities on organization execution ought to be considered at the same time, since they are together controlled by exogenous and endogenous elements also, may fill in as substitutes or supplements. For example, low proprietorship fixation might be joined by high extent of outside executives in the board: rather than holding expansive stakes and spending huge assets for coordinate observing of administration activities, investors may name chiefs which ensure their interests to the board. Notwithstanding corporate administration factors, we incorporate into the relapses a few control factors, which, as the investigation of existing experimental research demonstrated, may likewise affect execution and ought to accordingly be considered keeping in mind the end goal to in any event incompletely control for heterogeneity. These factors incorporate organization estimate, use, liquidity, benefit, organization age, deals development and additionally industry sham factors (for 14 ventures altogether). Itemized portrayal of control factors was given in the “Information depiction” area. For organization execution we utilize two intermediary factors utilized in the greater part of the earlier investigations: Tobin’s Q and profit for resources (ROA). These factors have certain disadvantages as intermediaries for execution which incompletely repay each other. The estimation of Tobin’s Q is liable to stock advertise changes; on the opposite side, ROA is the subordinate of net pay and subsequently can be effortlessly controlled, moreover, ROA does not consider future execution of the organization and its money creating capacity and is in this way in reverse looking. General type of the model utilized for relapse investigation is given underneath. This is alleged base relapse display, assessed by conventional minimum squares (OLS), which will be additionally adjusted keeping in mind the end goal to consider in secret heterogeneity and switch causality.

4.3.5 Correlation Analysis

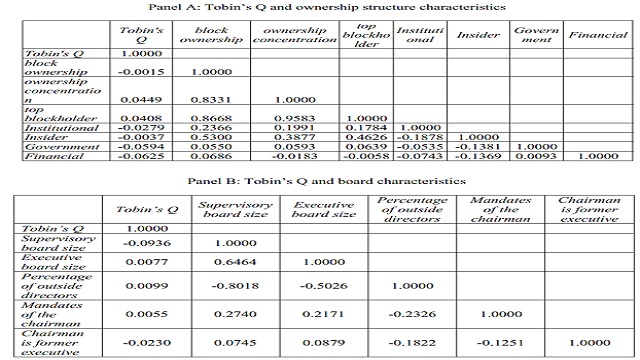

Panel A: The correlation regression to the data analysis is in respond to the format of the corporate governance as well as corporate governance structure where it is correlated to the other corporate performance in the series of the institutional performance, financial performance and others.

Panel B: The correlation regression data analysis is the assumption to have the correlation among the different form of ownership in the corporate governance as well as corporate governance structure and the corporate performance where they are correlated with the supervisory board size, executive board size, outside directors, chairman as well as former executive chairman.

4.3.6 Verification of Hypothesis

The Board of Trustees is considered an agent to reduce agency issues within the organization. According to the agency’s theory, there is a relationship between the size of the board and the results of the company’s operations. Researchers have suggested that large corporations are having difficulty communicating that could have a negative impact on the company’s performance. To address the problems of domestic and international management agencies such as Board of Directors, key shareholders, hostages, ease of use and financial structure, and have been introduced (Hart, 1995). The most important internal mechanism for corporate governance is the Board of Directors (Subramanian and Swaminathan, 2008). The role of the council not only fulfills its legal requirements. The company’s board of directors provides strategic guidance and guidance. The targeted solution, regardless of company management; And the company’s work is still the responsibility of shareholders. An effective management system is a part of which allows the Board to effectively implement these two functions. Nonetheless, shareholders do not deviate from agents’ investigations, leaving independent shareholders with shareholders interests (Hermalin and Weishbach, 1991). There are Board Members Adding Board members, including Board size, Board of Director, Independence, Board of Directors, and Fitness and Dietary Meals.

Boards are considered as the foundations to direct the effects of office issue existent in the affiliations. As shown by office speculation, there may be a relationship between board measure and corporate execution. Various examiners have suggested that generous scale board generally encounters issues in correspondence, which may have negative impact on association execution.

H1: Board measure strongly impacts the firm execution at more diminutive sizes taken after by a negative effect at greater sizes.

Exactly when boss claim the association’s stock, their stock wage depends upon the cost of the association’s stock, and better association execution can pull in wander from various money related masters, in this way growing stock expenses. Consequently, the higher the degree of offers controlled by chiefs, the higher the association’s execution.

H2: There is a positive connection between regulatory proprietorship extents and companions execution in list associations in UK.

As demonstrated by the accomplice theory and the advantage dependence speculation, all people from the representing body are connected with social events of different sorts and levels. sexual introduction arranged assortment prompts the extension of interest social occasions. The varying assortment of the best administrative staff can think about the interests of different social affairs.

H3: The venture of female boss decidedly influences association execution.

Moreover, as shown by office theory, a higher degree of external staff on the board can all the more probable screen and control the cunning behavior of current organization, in this way constraining office issues and opening up speculator wealth (Fama and Jensen, 1983). Thusly, the board should have a prevailing piece of outside administrators in light of the fact that a more elevated amount of untouchables can update board self-rule, give more broad learning and experience, and improve the convincing working of the board (Bacon and Brown, 1973) Fama and Jensen (1983) furthermore support this by giving a view that independent sheets are more objective in checking associations than without non sheets.

H4: There is a significant association between degree of Independent Non-Executive Director and the corporate execution for UK Listed Companies.

When managers hold company shares, their revenue from their stock, based on stock price and better performance, the company can attract investment from other investors, increasing the cost of the share. So the larger the size of the capital management, the higher the productivity of the company. According to the theory of stakeholder and resource-supporting theology, all members of the board of directors are linked to different groups of different types and levels. Gender diversity leads to the diversification of interest groups. The diversity of the State Council can be seen from different groups of interests. In addition, more shareholders, theoretical agents, external staff on the board can better monitor and control behavior management, thereby reducing the problem of mediating and creating wealth. From the shareholders (Fama and Jensen, 1983). Therefore, it must have a majority of the votes on the Board of Directors, the Executive Director at the highest level, to increase the Board’s independence to ensure greater knowledge and experience and to improve the effective functioning of the board. The Board of Trustees (Bacon and Brown, 1973) support what the Independent Steering Committee has more goals in its management when the company does not provide independent advice. In response to the null hypothesis (H4) it is to be explained the following board dimension whether it is accepted or rejected. The above discussion is the clarification in response to the board dimension as well as the board roles as per the null hypothesis (H4).

There are two main roles that provide advice and guidance. First, the function of consulting services can be seen as an advice to experts and access to key information and resources for companies (Fama and Jensen 1983). They also noted the importance of external leaders, bringing with them valuable experiences and potential resources. The benefits of the Board of Trustees are general information that the Board of Directors receives over time, and therefore the core will lead to higher productivity (Dalton and Associates, 2005). These two leaders are responsible for managing the management to ensure that the CEO observes the interests of the shareholders. Numerous previous studies on decision making have shown that larger groups need more efforts to achieve consensus, with the group’s final decision reflecting not just the group Small. (Kogan and Wallach, 1966). As a result these two features provide better performance of the ship as it improves its performance. Based on the agency’s relationship, the relationship between the size of the Board of Directors and any changes in the operation of the Board of Directors is problematic with contact with the agent. First, coordination and communication issues arise because it is difficult for the facilitator to reach consensus, leading to a delinquent and inefficient solution (Jensen 1993). The second point of the Board of Trustees, which is down to the Board of Directors, will share almost unrelated and unrelated relationships, based on a different perspective on the board (Lipton et Lorsch 1992). Third, rates for directors have increased. Due to the director’s inconvenience, it is proportional to the size of the board. The CEO is likely to influence and lead the board of directors. As a result, the strength of CEO increased with the size of Board of Directors (Lipton et Lorsch 1992). Jensen (1993) believes that if the council has more than eight leaders, the leader cannot function well and the executive can manage. As the Board progresses, it is more difficult for the company to convene its Board of Trustees, Board of Directors and Board Meetings to reach consensus. As a result, the board’s decision was very limited. According to Jensen (1993) by increasing the size of the board of directors, the costs and communications in facilitating the issue will lead to more directors to take advantage of the potential for reducing the effectiveness. Numerous studies in the United States, documenting the relationship between the size of the Board of Directors and the results of operations of Hermalin and Weisbach (2003), concluded that this relationship is one of the clearest and evidence of Literature books. Using data from 452 American corporations between 1984 and 1991 therefore Yermack (1996), the negative relationship between Board size and Company performance was measured by asking questions and Tobin’s profit. Eisenberg et al. (1998) argued that Yermack’s findings, their findings suggest that there is a similar link between Finnish small and medium-sized enterprises. This means that the size of the board is negatively correlated with the value of the company. Another test data test for 1,252 companies that came from IRRC data from 1996 to 2004 by the company director. The results show that between Board of Directors and Low-income Income Company returns to ROA’s assets and the value of Tobin Q is linked. Due to the size of the board rising by standard deviation, the standard deviations of monthly capital decreased by 7% and 8%. The same increase in the size of the Board of Directors, the average annual distribution of Tobin, decreased 9% (14%) and 17% (36%). Depending on the theory of reliance, the Board’s resources are managed and supervised by the management and resources. The theory of reliance on research indicates that the company relies on their environment (Pfeffer, 1972). The company must provide environmental resources that help to reduce uncertainty and improve the company’s performance (Pfeffer, 1972). Differentiated advice provided by various boards supports the ability to provide decentralized environmental resources (Hillman & Dalziel, 2003). The European Commission is seeking more women as Board Members as they can diversify Board of Directors, which have a positive impact on Board of Directors. Their idea is to create a gender equality quota that encourages women on the plane. In this study, the Board of Directors considered the relationship between board diversity, aircraft age, aircraft, race and education, and company performance (such as return on assets). In addition, the possible roles of gender quotas in the relationship between council diversification and corporate performance have been identified. The model covers 468 companies from 12 European companies operating in the commercial and service sectors and at least one woman in the Board of Directors. The results show that there is strong relationship between women in the board of directors and the results of the company’s operations. In examining the characteristics of these women, the results show that there is no positive relationship between council diversity and age, racial level, and women’s education in the board of directors and corporate performance. The results also show that the gender equality quota does not have a minimal impact on the expected relationships between women in the Board of Directors and the Company’s results. But there are still some studies that show the negative relationship between the board’s diversity. Some researchers have claimed that various councils have found conflicts that affect the company’s progress (Arena et al., 2015). These conflicts come from mixed opinions and important issues that increase the time to deal with. Companies operating in the competitive industry need to respond quickly to a market crisis, which is why misunderstanding may have a negative impact on the company’s performance (Smith et al., 2006).

-

Limitations of this Study

Due to the lack of sufficient research time, data collection may not be extensive. In Selecting Variable Variables and Variable Explanations although this article discusses some of the key factors, analysis does not include variable variables with some explanations, such as in the industry. As we all know, the impact of capital management differs between the look and the strength of the industry. Therefore, the results of the study are not considered to be isolated from specific industries that affect the outcomes of the study. When ergo2 approval is approved, researchers will use this data to collect data carefully and legally.

References

Alex., 2006. Managerial ownership, risk, and corporate performance. International Journal of Commerce & Management, 16(2), pp.86-94.

Ansari, J.a., 2006. Managerial ownership, risk, and corporate performance. International Journal of Commerce & Management, 16(2), pp.86-94.

Arena, C.C.A.M.D.P.S.&.S., 2015. Women on board: evidence from a masculine industry: Corporate Governance. Corporate Governance , 15(3), pp.339-56.

Bos, S.P.A.a.T.S., 2011. Governance Thresholds, Managerial Ownership and Corporate Performance: Evidence from the UK. Social Science Electronic Publishing, 14(2), pp.152-59.

Bleger, J., 1972. Size and composition of corporate boards of directors: The organization and its environment. dministrative Science Quarterly, 17(4), pp.218-28.

Hart, O., 1995. Corporate Governance and corporate governance structure: Some Theory and Implications. The Economic Journal, 105(430), pp.678-89.

Jacobs, S.P.A.a.T.S., 2011. Governance Thresholds, Managerial Ownership and Corporate Performance: Evidence from the UK. Social Science Electronic Publishing, 14(2), pp.152-59.

Jacklin, J.a., 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), pp.305-60.

Krena, C.C.A.M.D.P.S.&.S., 2015. Women on board: evidence from a masculine industry: Corporate Governance. Corporate Governance , 15(3), pp.339-56.

Lizat, R.&., 2015. How relevant is dividend policy under low shareholder protection? Journal of International Financial Markets, Institutions and Money, 4(2), pp.16-26.

Meckling, J.a., 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), pp.305-60.

Michael, H.B.a.W., 1991. The Effects of Board Composition and Direct Incentives on Firm Performance. The Journal of the Financial Management Association, 20(4), pp.101-12.

Pfeffer, J., 1972. Size and composition of corporate boards of directors: The organization and its environment. dministrative Science Quarterly, 17(4), pp.218-28.

Porlu, 2016. Strategic Engagement for Gender Equality. Luxembourg: Publications Office for the European European Commission.

Simms, G.&., 1999. Corporate governance and corporate governance structure: What it is and why it matters. In. Kuala Lumpu: International Anti-Corruption Conference.

Simmons, G.&., 1999. Corporate governance and corporate governance structure: What it is and why it matters. In. Kuala Lumpu: International Anti-Corruption Conference.

Stada, S.a., 2008. Corporate Governance in India: A Survey of the Literature. Icfai Journal of Corporate Governance, 7(3), pp.31-45.

Stewart, H.B.a.W., 1991. The Effects of Board Composition and Direct Incentives on Firm Performance. The Journal of the Financial Management Association, 20(4), pp.101-12.

Swaminathan, S.a., 2008. Corporate Governance and corporate governance structure in India: A Survey of the Literature. Icfai Journal of Corporate Governance, 7(3), pp.31-45.

Szilagyi, R.&., 2015. How relevant is dividend policy under low shareholder protection? Journal of International Financial Markets, Institutions and Money, 4(2), pp.16-26.

Tolly, O., 1995. Corporate Governance and corporate governance structure: Some Theory and Implications. The Economic Journal, 105(430), pp.678-89.

Union, 2016. Strategic Engagement for Gender Equality. Luxembourg: Publications Office for the European European Commission.

Written by

Email: [email protected]