Causes of Global Financial Crisis

Introduction

The Global Financial Crisis since 2007-2008 was the drastically fall of the economic condition worldwide, the financial market fully collapsed and many investors lost their investment and as a consequences it creates a great depression in the aspect of financial crisis. There was high risk in the financial product trading along with the complex financial products in the market including the fact of undisclosed conflicts of interest which were unknown to the stakeholders, there was huge sorts of failure in the regulation of trading for the Causes of Global Financial Crisis. Due to the global financial crisis there was an negative effect in the version mirroring trends in developed country markets which actually slower growth of the market in terms of stock prices as well as stock return along with which the dollar exchange rates was very peculiar.

Causes of Global Financial Crisis

The financial crisis of 2007–2008 as well as the global financial crisis is called the worst financial crisis in the history of economy since there was a great depression in the year of 1930.

Since the time of 2007 the crisis began with the subprime mortgage market in the US, and speculative international banking crisis with the collapse of the investment bank and the huge disaster in the financial market that cause to financial negative impact globally. As a result the world faced global economic downturn, the Great Recession. Thus it is found out several Causes of Global Financial Crisis in 2007-2008 those are given below:

- There was high risk in the financial product trading along with the complex financial products in the market including the fact of undisclosed conflicts of interest which were unknown to the stakeholders, there was huge sorts of failure in the regulation of trading that makes the market vulnerable even though the credit rating agencies were not more capable of rating the stock in the high standard format and the market itself cause to back thorough to rein in the excesses of Wall Street. (Amadeo, 2017)

As a result it was seen, in 2005 to 2006 the in investor who had the stock of values 50 lac he became zero as his all stock price declined as the market fully collapsed that Causes of Global Financial Crisis.

- It was found and researched by the The Financial Crisis Inquiry Commission that there was widespread failures in the terms of financial rules and regulation and also there was massive failures of corporate governance mechanism. There was systematic problem in the mechanism of risk management.

As a result, there was found no clue as it has been occurred as there was huge mismanagement of the financial rules and regulation that Causes of Global Financial Crisis.

- It was also discovered that there was a combination of excessive borrowing in the full composition of the market as well as the number of risky investments were not utilized and upgraded time to time.

As a result, different parties accessed to bankruptcy, thus make the procedure in financial borrowing from different bank, thus the bank also faced bankruptcy that Causes of Global Financial Crisis.

- Along with the problem of risk management there was a lack of transparency provided by financial institutions and action performed by the government regarding the market economy policy was under standard. (Amadeo, 2017)

No general guideline was given time to time to the parties or the contributors of the party.

- There was a systemic breakdown in accountability and ethics that raise the question of manipulation.

The whole situation was beyond the ethical standard.

- More importantly it became the huge failure of the credit rating agencies as they failed to price the risk correctly.

- The parties who were involved with mortgage related financial products and it was found that the governments was not serious or did not consider adjusting their regulatory practices to address 21st-century financial markets. (Havemann, 2008)

Impact of financial crisis on financial markets in Africa

The reason behind to analyze the financial market is for Africa and that time it was seen African financial market did not work properly. And it was a massive damage in the financial market from the view point of its financial crisis. As a result it will be great option to analyze the country’s economy and get to help know about the customer.

There was vulnerable impact due to the financial crisis globally make the market down to felt on stock markets and foreign exchange markets.

For example: If the dollar valuation was 80% in terms of African currency then it becomes the devaluation of dollar at approximate 20-30%

Due to the global financial crisis there was an negative effect in the version mirroring trends in developed country markets which actually slower growth of the market in terms of stock prices as well as stock return along with which the dollar exchange rates was very peculiar that also presenting the worldwide trends dollars as the hardcore of currency. (Bank, 2009) Now the data is given for more understanding:

| Year | 2005 | 2006 | 2007 |

| Stock Price | 10.13 | 11.12 | 1.15 |

Thus it shows a drastically fall in the stock prices.

It was vastly impacted to make the present moment in the prospect of consumption for consumer due to the failure in commodity prices and decreasing export receipts where it was being more challenging for the international financial system of South Africa in which the country would like to expose.

| Year | 2005 | 2006 | 2007 |

| Consumption % | 56% | 59% | 23% |

Thus it shows a drastically fall in the percentage in consumption unit.

For consecutive 4 years with the GDP at 5% p.a., the GDP of South Africa remains slow in terms of growth due to the crisis.

In Nigeria, the stock market had also faced huge decline in the month of March 2008 due to financial crisis along with where all Share Index downgraded more than 60 percent of its value. As a result it has made the market lead to increases in non-performing loans and taken the financial policy for the lending for the purpose of undertaken the lending for stock purchases and raises the cost of issuing new capital.

Moreover, Kenyan assets have been depreciated by 19 percent against the US dollar. As a result, the adjustment shows the economy high domestic inflation that create a burden to the citizen.

In addition to, stock market of Ghana has under rated by the Standard and Poor’s and Fitch rating agencies because there was a large budget deficit in the economy.

Finally, The SEMDEX index in Mauritius has been decreased as well reduced or declined by 44 percent against the dollar and due to decrease in the foreign investment total market capitalization was under rated. (Bank, 2009)

Monetary and fiscal policies used to stimulate nation’s economy towards recovery

Monetary Policy

Monetary policy is the macroeconomic policy that is prepared by the central bank by considering the macroeconomic factor of the economy of a country. (Times, 2017). That means it is the actions of a central bank, currency board or other regulatory committee to determine the size and growth rate of the economy which actually affect the interest rate containing in the market due to the management of money supply and interest rate by considering the factor like inflation, GDP, GNP etc. (Stiax, 2014)

The primary objective of monetary policy in Africa is to maintain the great range of price stability in the interest good as well as better balanced economic development and growth for the economy where as there should have a favourable environment for growth perspective and employment creation by introducing new business and expansion of business. Moreover, the inflation will be at low inflation as the purchasing power of all the citizens of Africa remain on their purchasing ability. (Bank, 2017)

Fiscal policy

Fiscal policy is the policy by which a government is able to adjust as well as scheduled government spending levels and tax rates for tax revenue collection to monitor the influence of a country’s economy. It is the supporting strategy of the government to monetary policy as the central bank can utilize the money supply.

The fiscal policy of African government is the policy of collecting more tax for the purpose of meeting the spending requirement by the government. (Ersa, 2017)

Stimulation and recovery of Monetary and fiscal policy

The monetary stimulation can be described as the interest rate of debt financing is high in the market that entails that the money supply in the market is not available, it the scenario contuse then the government must make the money supply available by decreasing the debt financing cost and increasing the deposit interest.

The financial stimulation will be reducing the tax rate by the government and increasing the rate of public debt. (Money, 2014)

Recovery in the monetary policy can be possible if the monetary policy moving slowly, then it could be recovered by decreasing the interest rate and increasing the money supply.

Recovery in the fiscal policy can be possible if the fiscal policy moving slowly, then it could be recovered by decreasing the tax rate and increasing the rate of public debt. (Bartmann, 2017)

Macroeconomic indicators for the recovery in Africa since 2009 (Bloomburg, 2009)

| Indicator | 2007 | 2008 | 2009 |

| Agriculture | 1661 hector | 1869 hector | 2065 hector |

| Loans interest rate | 7.75 | 8.05 | 8.15 |

| Food import | 19322 | 20225 | 21221 |

| Exchange Rate | 12.25 | 12.55 | 12.95 |

| Inflation Rate | 5.07 | 6.65 | 7.01 |

| Unemployment rate | 16.15 | 16.85 | 18.81 |

Source: Bloomberg Economy Review of African since 2009

Agriculture

The development in the agriculture was done by the help of government subsidy in the agricultural sector.

Loans interest rate

The interest rate of the bank was kept at favorable priced as the entrepreneur can grow the business field.

Food import

As the agriculture was continually developing, side by side it was being utilized a food import practice to keep the economy balancing with the export.

Exchange Rate

The exchange rate was being readjusted for a certain time as the international trade runs successfully.

Inflation Rate

By decreasing the interest rate with the proper money supply in the market leads to keep the inflation below average.

Unemployment rate

With the expansion of business area, new source of employment was being created that was keeping the unemployment rate reducing. (Doya, 2017)

Trends and directions for the future in Africa

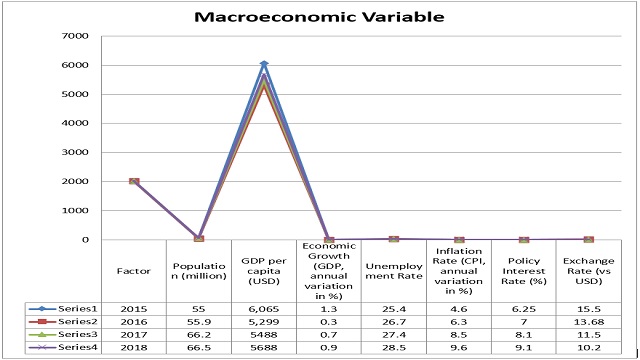

| Factor | 2015 | 2016 | 2017 | 2018 (Projected) | 2019

(projected) |

| Population (million) | 55 | 55.9 | 66.2 | 66.5 | 66.90 |

| GDP per capita (USD) | 6,065 | 5,299 | 5488 | 5688 | 5810 |

| Economic Growth (GDP, annual variation in %) | 1.3 | 0.3 | 0.7 | 0.9 | 0.95 |

| Unemployment Rate | 25.4 | 26.7 | 27.4 | 28.5 | 29.5 |

| Inflation Rate (CPI, annual variation in %) | 4.6 | 6.3 | 8.5 | 9.6 | 10.10 |

| Policy Interest Rate (%) | 6.25 | 7 | 8.1 | 9.1 | 10.00 |

| Exchange Rate (vs USD) | 15.5 | 13.68 | 11.5 | 10.2 | 10.8 |

Graphical Presentation: Trends and directions for the future in Africa

In 2018, the trends of the entire macroeconomic factor are forecasting as the increasing perspective by considering the previous data except the exchange rate is decreasing. (Ersa, 2017)In cases of population, it is increasing year to year comparatively than the previous year thus the projected population for 2018 is estimated 66.5. Then considering the GDP, it is seen that GDP is increasing year to year comparatively than the previous year thus the projected GDP for 2018 is estimated 5688. The another factor is Economic growth, it is seen that economic growth as well as GDP growth is increasing year to year comparatively than the previous year thus the projected economic growth as well as GDP growth for 2018 is estimated 0.90. Now, considering the unemployment rate, it is seen that unemployment rate is increasing year to year comparatively than the previous year thus the projected unemployment rate for 2018 is estimated 28.5 and it’s a good sign where many people are engaging in employment and contributing to the economy by their labor force. Then the inflation rate to determine the purchasing power of the people it is seen that is inflation rate is increasing year to year comparatively than the previous year thus the projected inflation for 2018 is estimated 9.60 that is the alarming situation for the country as the inflation rate is going high because inflation rate increases determine the less purchasing power of the customer. Considering the interest rate policy where it is seen that interest rate is increasing year to year comparatively than the previous year thus the projected population for 2018 is estimated 9.1 as it is motivating to deposit more because there is shortage of money supply and the interest rate is increasing year to year and the deposit rate is increasing year to year. Finally, considering the exchange rate where it is seen that exchange rate is decreasing year to year comparatively than the previous year thus the projected population for 2018 is estimated 10.20 that the value of dollar is decreasing and the value of local currency is increasing. (Focus, 2017)

Conclusion:

Due to the global financial crisis there was an negative effect in the version mirroring trends in developed country markets which actually slower growth of the market in terms of stock prices as well as stock return along with which the dollar exchange rates was very peculiar. And its impact on the financial market was too severe. Many investors have lost their full investment; The time was too horrible to pass the day under the great depression in the economic recession. Besides this, the country which I have chosen that is Africa that has been faced a lot of financial pressure as there was no development in the country. But the times change African nations are doing well in every aspect.

References

Amadeo, K., 2017. 2007 Financial Crisis: Explanation, Causes, Timeline.

Bank, W., 2009. The Impact of the Global Financial Crisis.

Bank, R., 2017. Monetary Policy.

Bartmann, R., 2017. Causes and effects of 2008 financial crisis. Thesis. Raphael Bartmann.

Bloomburg, 2009. Bloomburg Africa.

Doya, D.M., 2017. Worst May Be Over as Biggest Africa Economies End Growth Rut.

Ersa, 2017. Effects of Fiscal Policy in Africa.

Focus, 2017. South Africa Economic Outlook.

Havemann, J., 2008. The Financial Crisis of 2008: Year In Review 2008.

Money, P., 2014. FINANCIAL CRISIS & RECESSIONS.

Singh, M., 2008. The 2007-08 Financial Crisis In Review.

Stiax, 2014. Monetary Policy in African Countries.

Times, E., 2017. Definition of ‘Monetary Policy’.

Written by

Email: [email protected]