Ratio Analysis of Oxford Instruments Plc and Morgan Advanced Materials Plc

Oxford Instruments plc (Ratio Analysis of Oxford Instruments and Morgan Advanced Materials) is the UK assembling and think-tank that structures and fabricates devices and frameworks for industry and research. The organization is headquartered in Abingdon, Oxford shire, England, with destinations in the UK, United States, Europe, and Asia. It is recorded on the London Stock Exchange. Oxford Instruments plc, through its backups, explores, creates, produces, leases, offers, and administrations apparatuses and frameworks in the United States, rest of Europe, rest of Asia, the UK, Japan, China, Germany, and globally. The organization’s Nanotechnology Tools section gives elite logical imaging cameras, spectroscopy arrangements, and microscopy frameworks for research and OEM markets; nuclear power test microscopy for materials and bioscience applications; 3D and 4D picture perception and investigation programming; and Nanoanalysis answers for materials portrayal and nanofabrication on examining electron magnifying instruments, focused particle bars, and transmission electron magnifying instruments.

This fragment likewise offers to examine instruments for physical sciences, and process answers for the drawing of nanometer measured highlights and additionally gives Nano layer affidavit and nanostructure controlled development administrations. It’s Industrial Products portion offers investigative X-beam fluorescence, laser prompted breakdown spectroscopy, optical outflow spectroscopy, and attractive reverberation instruments for the quality affirmation and creation enhancement, and also examine apparatuses; atomic attractive reverberation instruments; and X-beam tubes. The organization’s Service portion offers revamped and versatile CT and MRI hardware, upkeep administrations, and parts. Its items have applications in the farming, nourishment and drink, synthetic substances and oils, gadgets, vitality/condition, disappointment examination, legal sciences, human services, industry and transport, data and correspondence tech, metals, minerals and mining, nanotechnology, quality control and consistency testing, research and the scholarly world, semiconductors, and materials segments.

The organization was established in 1959 and is headquartered in Abingdon, the UK. And, finally, the future prospect of Oxford Instruments plc is that despite the fact that OXIG’s obligation level is moderately low, its income levels still couldn’t extensively cover its borrowings. This may show an opportunity to get better as far as its working effectiveness. In any case, the organization displays a capacity to meet its close term commitments should an unfavorable occasion happen. Remember that different factors, for example, how OXIG has been performing in the past should keep on investigating Oxford Instruments to get a more all-encompassing perspective of the stock by taking a gander at Future Outlook, Valuation and Other High-Performing Stocks.

Ratio Analysis

The Need for Ratio Analysis

Compelling arranging and monetary administration are the keys to maintaining a fiscally fruitful independent company. Ratio analysis is basic for helping you comprehend financial statements, for distinguishing patterns after some time and for estimating the in general budgetary condition of the business. Moreover, moneylenders and potential financial specialists frequently depend on ratio analysis when settling on loaning and contributing choices. The need for ratio analysis as pursues:

- To give meaning to the absolute figure

- For arranging and forecasting

- It is a tool of decision making

- To analyze results and execution

- For an investigation of strengths and shortcoming

- For analyzing the change in the form of trend

The Limitation of Ratio Analysis

- Limitations of Financial Statements

- Historical Information

- Different Accounting Policies

- Lack of Standard of Comparison

- Window-Dressing were introducing the money related explanations in such an approach to demonstrate a superior position than what it really is Changes in Price Level

- Ratios Account for one Variable and they can’t generally give amend picture since a few different factors such Government arrangement, financial conditions, accessibility of assets and so forth ought to be remembered while translating proportions.

- Seasonal Factors Affect Financial Data

Ratio analysis of Oxford Instruments plc

Efficiency ratios

Inventories turnover period ratio = cost of goods sold/Average Inventory

- 2015 = 214/ (68+71) = 0.65 times

- 2016 = 201 / (71+61) = 1.52 times

- 2017 = 167 / (61+54) = 1.45 times

- 2018 = 146 / (54+46) = 1.46 times

Trade receivables collection period ratio = (Trade Receivable/Credit Sales) x 365

- 2015 = (76 / 386) X 365 = 71.86 days

- 2016 = (67 / 362) X 365 = 67.55 days

- 2017 = (71 / 348) X 365 = 74.47 days

- 2018 = (61 / 297) X 365 = 74.97 days

Trade payables payment period ratio = COGS/ Average Payable

- 2015 = 214/ (38+36) = 2.89 times

- 2016 = 201/ (36+34) = 2.87 times

- 2017 = 167 / (34+32) = 2.53 times

- 2018 = 146 / (32+25) = 2.56 times

Note: There are a few issues to know about when utilizing this figuring. Organizations in some cases measure Trade payable days by just utilizing the COGS in the numerator. This is erroneous If an organization just uses the expense of merchandise sold in the numerator, this outcome in a too much modest number of payable days.

Liquidity Ratios

Current ratio = Current Asset/Current Liabilities

- 2015 = 190 / 144 = 1.319

- 2016 = 165 / 125 = 1.32

- 2017 = 167 / 121 = 1.38

- 2018 = 145 / 103 = 1.41

Acid test ratio = (Cash + Account Receivable) / Current Liabilities

- 2015 = (25+76) / 144 = 0.70

- 2016 = (22+67) /125 = 0.71

- 2017 = (27+71) / 121 = 0.81

- 2018 = (21+61) / 103 = 0.80

Capital Structure Ratios

Gearing ratio = Total debt / Total Equity

- 2015 = 349 / 126 = 2.77

- 2016 = 313 / 143 = 2.19

- 2017 = 282 / 132 = 2.14

- 2018 = 166 / 180 = 0.92

Interest cover ratio = EBIT/ Interest Expense

- 2015 = 18 / 2 = 9 times

- 2016 = 26 / 2 = 13 times

- 2017 = 42 / 1 = 42 times

- 2018 = 34 / 4 = 8.5 times

The equity ratio = Total equity / Total assets

- 2015 = 126 / 474 = 0.27 = 27%

- 2016 = 143 / 456 = 0.31 = 31%

- 2017 = 132 / 414 = 0.32 = 32%

- 2018 = 180 / 345 = 0.52 = 52%

Investment Ratios

Earnings per share (EPS) ratio = Earnings / Outstanding shares

- 2015 = -6 / 57 = -0.11

- 2016 = 7 / 57 = 0.12

- 2017 = -20 / 57 = -0.35

- 2017 = 66 / 57 = 1.16

P/E ratio = Price / EPS

- 2015 = 914 / -0.11 million = -0.0083 = -0.83%

- 2016 = 912 / 0.12 million = 0.0076 = 0.76%

- 2017 = 931 / -0.35 million = -0.0027 = -0.27%

- 2018 = 940 / 1.16 million = 0.0008 = 0.08%

Dividend Yield = Annual Dividend / Share Price

- 2015 = 7 / 914 = 0.76%

- 2016 = 8 / 912 = 0.87%

- 2017 = 7 / 931 = 0.75%

- 2018 = 7 / 940 = 0.74%

Dividend Cover = Net Income/Dividend

- 2015 = -6 / 7 = -0.86 times

- 2016 = 7 / 8 = 0.87 times

- 2017 = -20 / 7 = -2.86 times

- 2018 = 66 / 7 = 9.43 times

Ratio of Morgan Advanced Materials PLC

- Trade payables payment period ratio (2017) = 365/152.13 = 2.40 times

- The equity ratio (2017) = 195 / 930 = 21%

- P/E ratio (2017) = 338 / 0.38 = 0.09%

- Dividend Yield (2017) = 31 / 338 = 9.17%

- Dividend Cover (times) = 108 / 31 = 3.48 times

Here, the above ratios of Morgan Advanced Materials are not given in the appendix that is why it is calculated, therefore other ratio results are given in the appendix part collected from the financial statement of the company from Morning star website.

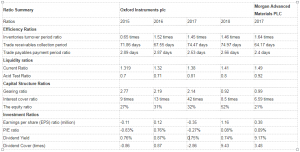

Ratio Summary

| Ratio Summary | Oxford Instruments plc | Morgan Advanced Materials PLC | |||

| Ratios | 2015 | 2016 | 2017 | 2018 | 2017 |

| Efficiency Ratios | |||||

| Inventories turnover period ratio | 0.65 times | 1.52 times | 1.45 times | 1.46 times | 1.64 times |

| Trade receivables collection period | 71.86 days | 67.55 days | 74.47 days | 74.97 days | 64.17 days |

| Trade payables payment period ratio | 2.89 days | 2.87 days | 2.53 days | 2.56 days | 2.4 days |

| Liquidity ratios | |||||

| Current Ratio | 1.319 | 1.32 | 1.38 | 1.41 | 1.49 |

| Acid Test Ratio | 0.7 | 0.71 | 0.81 | 0.8 | 0.92 |

| Capital Structure Ratios | |||||

| Gearing ratio | 2.77 | 2.19 | 2.14 | 0.92 | 0.99 |

| Interest cover ratio | 9 times | 13 times | 42 times | 8.5 times | 6.59 times |

| The equity ratio | 27% | 31% | 32% | 52% | 21% |

| Investment Ratios | |||||

| Earnings per share (EPS) ratio (million) | -0.11 | 0.12 | -0.35 | 1.16 | 0.38 |

| P/E ratio | -0.83% | 0.76% | -0.27% | 0.08% | 0.09% |

| Dividend Yield | 0.76% | 0.87% | 0.75% | 0.74% | 9.17% |

| Dividend Cover (times) | -0.86 | 0.87 | -2.86 | 9.43 | 3.48 |

Ratio Comparison of Oxford Instruments Plc and Morgan Advanced Materials Plc

Efficiency ratios

-

Inventories turnover period ratio

Here, the inventory turnover period of Oxford Instruments plc is fluctuating over the years, whereas in 2018 its ratio is 1.46 times which more than 2017 is, but in 2017 the ratio is decreased in 2017 compare to 2016 which means that the firm is not highly efficient to sell its inventories in 2017. On the other hand, the competitor ratio of Morgan Advanced Materials plc is better than Oxford Instruments plc in 2017 which is 1.64 times that means competitor Morgan Advanced Materials plc is more efficient to sell its inventory in 2017. Therefore, the competitor is performing better.

- Trade receivables collection period ratio

Here, Trade receivables collection period ratio of Oxford Instruments plc is increasing over the years which means the firm is taking more time to collect its receivables from the customer. This is not a good sign to take more time to collect the receivable because it may create a liquidity problem as well as a bad debt problem. On the other hand, the competitor Morgan Advanced Materials plc is taking less time in 2017 compared to Oxford Instruments plc, and doing a great job to collect its receivable within a less a time. Therefore, a competitor is performing better.

- Trade payables payment period ratio

Here, Trade payables payment period ratio of Oxford Instruments plc is decreasing over the time which means the firm is taking the opportunity to utilize the available cash efficiently but it also shows that how much efficient the firm is to pay the bill of credit purchase, in that case, it is minimizing the gap between the credit purchase and bill payment, and it is good sign. On the other hand, the competitor Morgan Advanced Materials plc is taking less time which means it has less gap between credit purchase and bill payment in 2017 compare to Oxford Instruments plc and also it is utilizing less the available money to retain the fund for another business purpose. Therefore, the competitor is performing better.

Liquidity Ratios

- Current ratio

Here, the current ratio of Oxford Instruments plc is increasing over the and it is a good sign because it shows that the firm is increasing its ability to convert its asset into cash when it is required. On the other hand, in 2017, the Current ratio of the competitor Morgan Advanced Materials plc is more than the Oxford Instruments plc that means they are more capable to convert its asset into cash. Therefore, the competitor is performing better.

- Acid test ratio

Here, the Acid Test ratio of Oxford Instruments plc is increasing over the year though it is decreased little a bit in 2018 which is not the good sign it shows that the firm is increasing its ability to convert its asset into cash quickly when it is required. On the other hand, in 2017, the Acid Test ratio of the competitor Morgan Advanced Materials plc is more than the Oxford Instruments plc that means they are more capable to convert its asset into cash quickly. Therefore, the competitor is performing better.

Capital Structure Ratios

- Gearing ratio

Here, the debt-equity ratio of Oxford Instruments plc is not satisfactory though the ratio is decreased in 2018, up to 2017 it has too many debts against the equity which is riskier for the frim. On the other hand, the competitor Morgan Advanced Materials plc is having less debt than Oxford Instruments plc in 2017. Therefore, the competitor is performing better.

-

Interest cover ratio

Up to 2017, the Oxford Instruments plc is doing will interest cover which shows that they are providing more times interest against their loans, and it is a good sign. On the other hand, the competitor Morgan Advanced Materials plc is providing interest against loans less time than Oxford Instruments plc. Therefore, the firm is performing better.

-

The equity ratio

Here, the equity ratio of Oxford Instruments plc is increasing over the years which means that the proportion of total assets are financed by the equity at large and it is good for the level of leverage of the firm. On the other hand, the competitor Morgan Advanced Materials plc is having less equity ratio (21%) compare to the firm. Therefore, the firm is performing better.

Investment Ratios

- Earnings per share (EPS) ratio

The EPS of the firm is increasing over the year and it is good for the company to earn more per share. But the competitor Morgan Advanced Materials plc is having EPS 0.38 which is too far lower than the firm. Therefore, the competitor is performing better.

- P/E ratio

The P/E ratio of the firm is increasing over time and it means that the firm is earning more and more against the share price. And, it’s a good sign because it will increase the sale of stock. On the other hand, the competitor Morgan Advanced Materials plc is having more ration that the firm. Therefore, the competitor is performing better.

- Dividend Yield

Here, the ratio of the firm is decreased in 2017 and it shows that the annual dividend is decreasing compare to the share price, it means the company is retaining more fund for further investment. But the competitor Morgan Advanced Materials plc is having more dividend yield in 2017. Therefore, the firm is performing better.

- Dividend Cover

Here, the ratio of Oxford Instruments plc is increased in 2018 that means it can provide dividend 9.43 times but in 2017 the competitor Morgan Advanced Materials plc could provide dividend 3.48 times. Therefore, the firm is performing better.

Conclusion

So, at last, it could be said that the results of the above ratios are not accompanying good results rather it is giving good result for its competitor. In that case, the firm should have reduced the account receivable collection time, increase the inventory sold, increase the liquid ability and deal with its investment circumstances that may generate a better return from the investment.

Written by

Email: [email protected]

Great work, it helps me a lot. Thank You so much