Information Technology and its resources help the organizations to perform their operations efficiently and make them more productive. From the banking services perspective, the role of IT is indisputable. Information technology innovation and expansion is a blessing for the banking business. It has opened thousands of doors to serve the customers beyond their expectations. Barclays bank is using IT and IT resources for maintaining communication with its customers, shareholders, employees, etc. whereas Barclays is enabling to provide uninterrupted service to the employees and their customers. Moreover, Barclays Bank is providing E-banking facilities by ensuring 24/7 banking services facilities, increasing storage capacity and decreasing maintenance cost, providing quality services by using internet banking, or mobile banking apps and improving strategic management. There are some networks used for the customers and interacting with them conveniently like LAN, WAN, and MAN. Social and ethical issues are maintained strictly by IT as the privacy of customer and customer data is kept secret and confidential. Cyberbullying could be a risk for the banking sector but it could be protected by using all latest security mechanism that is also the part of IT.

Information Technology of Barclays Bank

Information systems and information technology play significant roles for the betterment of the business. It helps the organizations to perform their operations efficiently and make them more productive. With the help of information technology, they can perform their tasks quickly and conveniently (Chrisanthi Avgerou and Walsham, 2000). Most the organizations use different types of the network as per their need fulfillment networks such as- LAN, MAN and WAN or intranet or extranet. Here the uses of IT in the banking sectors are described precisely along with their overall business communication process.

Background of the organization

Here the chosen organization for the assignment is Barclays Bank. It is one of the most popular and reputed banks in the financial and banking business sectors. The banks are well known for adopting a different range of information technology support and solutions for their everyday problem solving (Chrisanthi Avgerou and Walsham, 2000).

Literature Review

Information Technology and its role in the banking business

As compared to other businesses, the banking sector has worked very efficiently in the improvement process of information technology. They are improving the technologies for grabbing more customers from the market and provide innovative services (Forester, 1985).

Different types of networking technologies

By using different types of networking technologies banking organizations are trying to stay in touch with their customers and facilitate enough flow of information for their better accessibility. The network technologies used by banks are LAN, MAN, WAN, etc. (Forester, 1985)

Social and Ethical Issues of adopting technology

Every new innovation has some positive and negative effects on the business economy. Practices of transforming from traditional way to the era of information technology have tremendous ethical and social concerns related to the issues.

The significance of the internet and intranet for Banks

Internet and intranet both are fundamental necessities of the banking organization. It is providing them numerous opportunities to innovate new banking services as well as using them for the betterment of their customers (Gordon Reeve, 1985).

Role of IT in the banking business

Information technology innovation and expansion is a blessing for the banking business. It has opened thousands of doors to serve the customers beyond their expectations. Here some of the major roles of IT are described in Barclays bank as follows for efficient use in the banking sector.

- To maintain communication: The banking business of Barclays bank is mostly depending on their continuous communication and service process. With the blessing of IT, they can easily communicate with their customers, shareholders, employees, etc. The management of communication and better efficiency has increased (Gordon Reeve, 1985). So Barclays is enabling to provide uninterrupted service to the employees and their customers.

- E-banking facilities: The IT infrastructure of Barclays has enabled E-banking facilities because a customer can avail banking services from home just using online baking, internet banking, mobile banking, or SMS banking options. Under these options, customers can check balances, request for checkbooks, request for fund transfer to other accounts, or even can maintain their deposit scheme. IT infrastructure of Barclays ensures 24/7 banking services facilities that’s why customers don’t have to worry about fund withdrawal as they have available ATM machines.

- Increase of storage capacity and decrease maintenance cost: Information management helps organizations to store, preserve, and maintain their precious and valuable information. Banks can store their financial data, employee records, transaction information safely, and reduce their overall maintenance cost for the storage facility. The Internet is providing them with secret options to preserve sensitive information safely.

- Providing Quality Service: The IT infrastructure of Barclays is providing quality service to their customer as a customer are getting full facilities of banking in his hand by using internet banking, or mobile banking apps. These internet banking or mobile banking apps enable them to purchase items from any online store. It enables the fund transfer facility within a minute to other bank accounts. Customer does not have to stay in a queue as these services are differentiated with different customer service managers in the bank.

- Improve strategic management: Banking sectors need their sensitive business and services information of their clients for better management and innovating new services. All of them are possible for the improvement of information technology and their continuous progress (Leow and Maclennan, 2000). Barclays can easily use their information for an efficient strategic management process.

Ethical and social issues related to Barclays banking business

Information technology is providing support to complete all kinds of banking transactions and related works easily and quickly. Some of the banks can use unethical ways to exploit the advantages of IT. It makes the process easier to copy and use any ideas of other companies without any copyright issues. The information of the employees and customers can get stolen easily by hackers and they can exploit that information to fulfill their evil needs. One of the most unethical things done by all the organizations to track online movements of the customers by using cookies and provide them offers of banking services, master card, visa card, credit card, debit card, etc. (Leow and Maclennan, 2000) facilities to use and offer. Because of such tracking and tracing of the information cyberbullying and cybercrimes are increasing day by day.

Different types of communication network

In banks there are different kinds of network connection are used to share information, resources, and software among the employees. There are some networks used for the customers and interacting with them conveniently (Shu and Strassmann, 2005). Some of the common network systems which are very popular in Banks are discussed below:

- Local area network (LAN)

- Metropolitan area network (MAN)

- Wide area network (WAN)

Figure: Different types of network used in the organization

LAN connection: LAN is the local area network basically designed for small geographical areas like offices, buildings, or a factory. Banks and other organizations mostly use the LAN network for a fewer number of people. It is very easy to use, set up, and solving any problems if needed. Organizations can use various set up to use the LAN network based on the necessity of the banks. It is helpful for serving the purpose of the banks to share files, information, using the same software and resources as well as communicating with different parties frequently (Shu and Strassmann, 2005). Barclays Bank uses LAN for its official purpose and they use it for the efficiency and productivity increase of their bank.

MAN: Metropolitan area network or MAN is used for setting up a medium kind of network. It is the larger version of the Local area network and the same kind of technology. Such kind of networks can cover a city and maintain their communication within the different parts of a whole city area (The Effect of Location and Information Technology on Banks Deposit Mobilization Status in Ethiopia: Empirical Evidence on Private Commercial Banks in Adama Town, 2015). Many small private and public limited organizations use MAN network technology for better data transmission and communication purposes.

WAN: Wide area network or WAN is used to a whole country or bigger region. It is hard to install WAN for any organization and need a lot of time and money for it. The connection covers a large area to maintain their communication with long-distance partners and share a workstation with the employees (The Effect of Location and Information Technology on Banks Deposit Mobilization Status in Ethiopia: Empirical Evidence on Private Commercial Banks in Adama Town, 2015). WAN is not always used by the Banks but for important use and data transferring purpose Barclays sometimes use WAN network.

Importance of internet and intranet in Barclays Banking Business

There is no way to deny the importance of the internet and intranet in the business sector. It is impossible to operate a business organization without the use of them. Barclays Bank is super-efficient and active in using the internet and intranet to provide the best service to its clients and keep continuous updates and communication with the shareholders, board of directors, and employees. Here the importance of Internet and Intranet are discussed below:

Intranet: Intranet is a privately designed network technology for using within the organization to maintain the communication process with the internal people of the organization. It provides safety and security to authorized people and ensures their secure communication through the authentic access by the network (The Effect of Location and Information Technology on Banks Deposit Mobilization Status in Ethiopia: Empirical Evidence on Private Commercial Banks in Adama Town, 2015). Most organizations are using LAN technology to increase their facilities of intranet networks and making their IT system more effective and advanced.

Internet: Internet is a public network system to collect information and communicating with people. It has created an opportunity to expand the business and find out business customers from millions of people from different parts of the world (Uppal, 2010). It helps the banks to solve their problems by providing their required information and target their desired customers. Importance of internet in banks is given below:

- Helps bank to get their target customers various information by using cookies

- Helpful to track the customer’s online activities and offer different service of the banks according to their customers need

- Design and develop ads to focus on customers and help them to suggest their needs for banking services

- It is useful for providing customer services (Uppal, 2010)

- The Internet provides information to analyze the market and make better business decisions

- Helps in case of employee recruitment, training and development programs (The Effect of Location and Information Technology on Banks Deposit Mobilization Status in Ethiopia: Empirical Evidence on Private Commercial Banks in Adama Town, 2015)

- Banks can take a survey from customers to evaluate their services and make further improvement based on the feedbacks

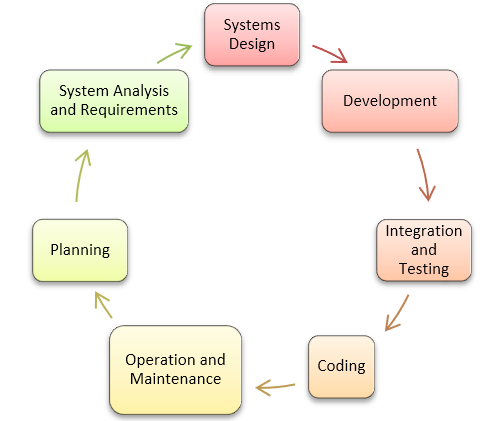

List and explain the different stage of the system development life cycle

Usually, 7 stages of the system development life cycle are used for the organizations to develop their life cycle of the system and design it according to their needs. Here the stages of system development in case of Barclays bank are given below:

- Planning

- System Analysis and Requirements

- Systems Design

- Development

- Integration and Testing

- Implementation or Coding

- Operation and Maintenance

- Planning: Firstly Barclays needed to start planning and deciding how and what they want to include in their new information system. How they want to target and attract their customers and what kind of information they want to provide them (Uppal, 2010). Then analysis all the resources needed for their system development and manage them efficiently.

- System Analysis and Requirements: The analysis is necessary for knowing about the performance of the software at various stages and take notes for further requirements and the necessity of Barclays.

- Design: Here the design stage is will make a blueprint of the software and include all the design of the application, network, databases, information, applications, user interfaces, and system interfaces for the overall design of the software prepared specially for the banks (Whaling, 1996).

Figure: System development life cycle of Barclays Bank

- Development: Now to develop the bank need to build their information system, buy Hardware, and installed them to align with all the coded software and load on a testing platform.

- Integration and Testing: The quality analyst staff will conduct the testing process on behalf of the bank and ensure the work progress and flawless system integration for Barclays.

- Implementation: After developing the software banks need to start the implementation process. After excessively testing the system it will be finally ready for use and it is the longest phase of the system development life cycle for any organization (Whaling, 1996).

- Maintenance: The final step is to review the maintenance process of the software. Give a basic overview of how it will be maintained and upgraded with the need, time, and different conditions. It totally depends on the customer’s feedback and flexibility. The system also needs to handle and use it and also solving errors, issues that can occur at any time.

Overall it is the basic steps to develop the system software and ensure its life cycle for the business organization. Unlike Barclays bank, any bank or other organizations can install, develop, and upgrade their system software according to their need and demands. It can also be modified, restore, and replace based on the requirements or suggestions of the customers for the competitive business facility and advantage.

Analysis of the benefits of Barclays bank from IT

With the advanced changes in the world, it is important to use IT for all of the business sectors. Without the efficiency and support from IT sectors, it is impossible to get the overall benefits of the business services and target the customers a bank needs to maintain. The overall set up of information technology will provide Barclays bank with the following benefits:

- It will increase their base of customers and target more potential customers of the market.

- The advancement of IT will provide the benefits of innovating new services and products on behalf of the banks and make them customer-friendly (Leow and Maclennan, 2000).

- It will create a safe and secure transaction of balances from banks to different banks, their branches, or to the customers.

- Enable them safely to protect secure information and prevent cybercrime.

Conclusion

Moreover, IT is bringing some biggest revolution in the society and banking business sector. So all the banks and their different department are using IT advantages to increase their efficiency and manage their employee’s and customers’ information (Leow and Maclennan, 2000). They are also using it for providing specialized and innovative service to the customers and employees for the betterment of the bank services. Barclays Bank is also not left behind in such IT segments technologies and advancement which are very praiseworthy and appropriate with the competitive business era.

References

- Chrisanthi Avgerou and Walsham, G. (2000). Information technology in context : studies from the perspective of developing countries. Aldershot, Eng. ; Burlington, Vt: Ashgate.

- Forester, T. (1985). The Information technology revolution. Cambridge, Mass.: MIT Press.

- Gordon Reeve, F. (1985). The banks and their use of information technology. Electronics and Power, 31(1), p.53.

- Leow, K.-M. and Maclennan, A. (2000). An investigation of the use of intranet technology in UK retail banks. Journal of Librarianship and Information Science, 32(3), pp.135–146.

- Shu, W., and Strassmann, P.A. (2005). Does information technology provide banks with profit? Information & Management, 42(5), pp.781–787.

- The Effect of Location and Information Technology on Banks Deposit Mobilization Status in Ethiopia: Empirical Evidence on Private Commercial Banks in Adama Town. (2015). International Journal of Science and Research (IJSR), 4(12), pp.616–620.

- Uppal, R.K. (2010). Banking and information technology. New Delhi, India: Anmol Publications.

- Whaling, C.L. (1996). Technological innovation and the U.S. banking industry: Innovation in the U.S. retail and wholesale banking sectors. Technology in Society, 18(4), pp.477–501.

Written by

Email: [email protected]