Financial Ratio Analysis

Financial Ratio Analysis

Introduction – Financial Ratio Analysis

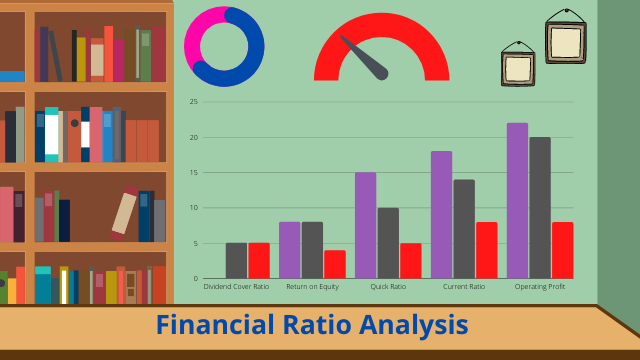

Financial ratio analysis are very helpful for taking decision regarding the choice of appropriate project for investment as there are so many financial factors are related (Foerster, 2015) . The firm is financially sound or not, financial performance is good or bad, debt is high or low, profit margin s high or low, each and every factors financial statements could be utilized by using financial ratio analysis. This study will focus on ratio analysis between Jones Ltd and Millet Ltd with recommendation to choose a project between this two. Even, this study will also focus on the cost classification in the production of goods and services.

- Ratio Analysis

Company: Jones Ltd

- Operating