Financial Planning for Personal Fund Management

Financial Planning of Charles and Monica

Financial Planning is a continuous process to make financial decisions about money that will help to use of money in proper manner in the perspective of expenses based on the income generation and also funding finance for investment purpose to achieve goals in life. Financial Planning for Personal Fund Management is done to analyze the income, expense, investment, debt equity and cashflow summary of an individual. This is the case study of Financial Planning for Personal Fund Management to conducted for Charles and Monica who are the resident from Australia.

In this regard, Personal financial planning is the part of financial planning for living standard where Personal financial planning means the financial management of an individual or a family unit performs to budgeting to adjust the income and expenses and utilize monetary resources over time like investment or financing taking into consideration of various financial risks and future life events.

Here, two persons named Charles and Monica; both are involved in professional jobs. They have certain income with different investment. They have assets like own home, two cars. Against those cars they have debt as liabilities. Moreover, they have insurance with a company from where they are expecting to be benefitted or want to minimize their future risk. When, different scenario come out to Charles and Monica’s life style then it became important to have a proper financial planning.

In this financial planning of Monica and Charles different account summary is included for preparing a better financial plan which will help them to execute their plan as where and how they want to invest, how they will do expenses, how they can go for financing.

Financial Planning for Personal Fund Management

Personal Fund management means to managing as well as maintaining the sources of fund of an individual. Here the sources of fund means the fund of that person in which he is depositing as well as saving or investing his different income in different funds. On this financial planning we have two people both are jointly maintaining and managing their personal fund in the different sources of fund. This two is named Charles and Monica; both are involved in professional jobs. They have certain income with different investment. They have assets like own home, two cars. Against those cars they have debt as liabilities. Moreover, they have insurance with a company from where they are expecting to be benefitted or want to minimize their future risk. When, different scenario come out to Charles and Monica’s life style then it became important to have a proper financial planning. And the financial planning comes from the personal fund management of Charles and Monica as they are contributing their income as well as personal income in different fund. Thus make the sense of doing the financial plan of personal fund management. This is to be noted that, in the circle of personal fund management of Charles and Monica they are allocating their personal fund in the different sources of fund which are given below.

Sources of Fund under Personal Contribution (Financial Planning for Personal Fund Management)

| Sources of Fund | Contributor | Fund Value ($) | Rate of Return | Return p.a |

| Golden Oldies Super Fund | Monica | 40000 | 5.28% | 2112 |

| Super Aus Balanced Growth Fund | Charles | 240000 | 7.00% | 16800 |

| Super GOS Conservative fund | Monica | 95000 | 8% | 7600 |

| Managed Fund | Monica | 30000 | 9% | 2700 |

| Share Portfolio fund | Charles | 40000 | 7% | 2800 |

The reason behind use of the above fund under consideration of personal fund management is that here Charles and Monica are not business person, actually they are funding their income fund in the different sources of fund for the purpose of getting benefit at the year end. And the above table is the summary of contribution in different fund of their personal fund management.

Net Worth Statement (Financial Planning for Personal Fund Management)

NWS is a financial document that represents the assets and liabilities of a company or individual.

Net Worth Statement

Charles & Monica

For the Year 2017/2018

| Particulars | Amount ($,000) | Amount ($,000) |

| Asset | ||

| Residence: | ||

| Primary Residence | 990.00 | |

| Home Contents | 120.00 | |

| Car: | ||

| Car (Audi A4) | 45.00 | |

| Car (Alfa Romeo) | 60.00 | |

| Fund: | ||

| Balanced option fund | 240.00 | |

| Retail Growth option fund | 44.50 | |

| Super Conservative fund | 95.00 | |

| Managed Fund | 30.00 | |

| Investment : | ||

| Share Portfolio | 40.00 | |

| Bank Balance: | ||

| AMP Bank (Term Deposit) | 10.00 | |

| Everyday A/C (AMP Bank) | 5.00 | |

| Everyday A/C (Westpac) | 2.00 | |

| Total Assets | 1681.50 | |

| Liabilities | ||

| Mortgage | 700.00 | |

| Car loan | 10.00 | |

| Total Liabilities | 710.00 | |

| Net Worth (Asset less Liabilities) | 971.50 |

Explanation: Net Worth of Charles and Monica is $971.50. That’s shows they have more assets than debt financing. In personal finance, it shows good when one have a lot of assets value but side by side it needs not to keep the money idle, it should be invested in different area or used in different sectors for the overall benefit.

Income Summary (Financial Planning for Personal Fund Management)

The income summary is the detailed income earning sources where each revenue account will be debited with the amount of its credit balance, and the total of all those debits will be entered as one credit in the account.

Income Summary

Charles & Monica

For the Year 2017/2018

| Particular | Rate | Amount ($,000) | Total ($,000) |

| Income | |||

| Interest Income: | |||

| Income from Balanced option Fund | 2.31% | 240.00 | 5.54 |

| Income from Growth option Fund | 5.28% | 44.50 | 2.35 |

| Income from managed fund | 9.00% | 30.00 | 2.70 |

| Income from Share portfolio | 7.00% | 40.00 | 2.80 |

| Bank interest income: | |||

| APM Bank | 3.00% | 10.00 | 0.30 |

| Everyday A/C (AMP) | 1.50% | 5.00 | 0.08 |

| Everyday A/C (Westpac) | 1.50% | 2.00 | 0.03 |

| Salary Income: | |||

| Charles | 88.30 | ||

| Monica | 31.08 | ||

| Other Income | 60.00 | ||

| Total Income | 193.18 | ||

Explanation: The major income sources of Charles and Monica is from their salary. Along with they have some investment in different fund which also giving return to them to add them in their income summary.

Expense Summary (Financial Planning for Personal Fund Management)

It is the summary of detailed expenses occurred in living life with some other circumstances.

Expense Summary

Charles & Monica

For the Year 2017/2018

| Particulars | Rate | Amount ($,000) | Total ($,000) |

| Expense | |||

| Interest Expense: | |||

| Mortgage Interest | 5.06% | $ 700.00 | 35.42 |

| Car loan interest (for 2 years) | 8.49% | $ 10.00 | 1.70 |

| Fees: | |||

| Home Annual Fee | 1.50 | ||

| Car loan Account Fee per month | 12 months | $ 10.00 | 0.12 |

| Insurance Premium: | |||

| Life and TPD (from balanced fund) | 0.85 | ||

| Life and TPD (from retail fund) | 0.85 | ||

| School Cost: | |||

| School fees | 18.00 | ||

| Uniform/Shoes | 2.50 | ||

| Books | 3.00 | ||

| Public Transport | 2.45 | ||

| Pocket Money | 5.00 | ||

| Motor Vehicle Expenses (Charles) | |||

| Insurance | 2.50 | ||

| Registration fee | 0.77 | ||

| Maintenance and Repairs | 1.75 | ||

| Fuel | 3.50 | ||

| Motor Vehicle Expenses (Monica) | |||

| Insurance | 3.50 | ||

| Registration fee | 0.77 | ||

| Maintenance and Repairs | 3.15 | ||

| Fuel | 2.50 | ||

| Portfolio Cost | 5.00 | ||

| Living Expense | |||

| Home Maintenance | 12.50 | ||

| Food | 11.52 | ||

| Shopping | 4.56 | ||

| Medical | 1.26 | ||

| Utilities | |||

| Gas | 1.90 | ||

| Electricity | 5.24 | ||

| Water | 1.86 | ||

| Council Rates | 2.55 | ||

| Telephone/Internet | 4.50 | ||

| Entertainment | |||

| Sport & Theatre | 4.50 | ||

| Gym | 1.30 | ||

| Pets | 0.99 | ||

| Cigarettes | 6.50 | ||

| Family policy cost | 2.26 | ||

| Holiday | 5.00 | ||

| Maintenance payment | 0.25 | ||

| Total Expense | 161.52 | ||

Explanation: The major source of expenses is in its interest expense against a mortgage loan. It will be continue for 5 years. All other expenses are relevant to living life.

Bank Summary (Financial Planning for Personal Fund Management)

The bank account summary shows the up-to-date position of an individual represented by cash in the bank, credit cards, loans and petty cash.

Bank Summary

Charles & Monica

For the Year 2017/2018

| Bank Name | A/C Holder | Balance($,000) | Interest Earned | Total Balance($,000) |

| AMP Bank | Joint (Charles&Monica) | 10.00 | 0.30 | 10.30 |

| Everyday Bank | Joint (Charles&Monica) | 5.00 | 0.08 | 5.08 |

| Westpac Bank | Monica | 2.00 | 0.03 | 2.03 |

| Total | 17.00 | 0.41 | 17.41 | |

Explanation: Interest earned from bank balance is also generating revenue as individual or jointly over the time.

Insurance Summary (Financial Planning for Personal Fund Management)

It is the summary of benefit and coverage of an individual upon its insurance premium over the time.

Insurance Summary

Charles & Monica

For the Year 2017/2018

| Insurance Type | Life and TPD | Car 1 | Car 2 |

| Insured | Monica’s Mum | Charles | Monica |

| Owner | Monica’s Mum | Charles | Monica |

| Beneficiary | Monica | Car 1 | Car2 |

| Type | Life | Accident | Accident |

| Death Benefit | After Death Cumulative Calculation | Based on circumstances | Based on circumstances |

| Annual Premium | Fixed $150 | 2.5 | 3.5 |

| Total Premiums Paid | – | 30 | 42 |

| Current Cash Values | 150 | 32.5 | 45.5 |

Explanation: Benefit from life insurance will be added cash flow in the year end of 2018 of Monica’s account.

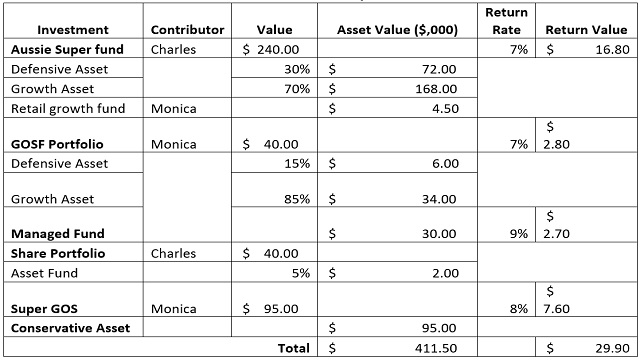

Investment Summary

An investment summary the detailed of investment which has been professionally prepared to meet the needs of future expectation.

Investment Summary

Charles & Monica

For the Year 2017/2018

Explanation: The major source of investment is on Aussie Super fund by Charles to meet up its future expectation

Cash flow Summary

The cash flow summary is one of the financial statements describes the cash flows into and out of the organization. Its particular focus is on the types of activities that create and use cash, which are operations, investments, and financing.

Cash flow Summary

Charles & Monica

For the Year 2017/2018

| Particulars | Amount ($,000) | Total ($,000) |

| Income | ||

| Income from salaries (Net) | 119.38 | |

| Interest from Bank Accounts | 0.41 | |

| Dividends from Shares | – | |

| Income from Investments | 29.9 | |

| Rental Income | – | |

| Other Income | 43.49 | |

| Total Income | 193.18 | |

| Expenses | ||

| Living Expenses: | ||

| Home Maintenance | 12.50 | |

| Food | 11.52 | |

| Shopping | 4.56 | |

| Medical | 1.26 | |

| 17.34 | ||

| Motor Vehicle: | ||

| Insurance | 3.50 | |

| Registration fee | 0.77 | |

| Maintenance and Repairs | 3.15 | |

| Fuel | 2.50 | |

| 9.92 | ||

| Utilities | ||

| Gas | 1.90 | |

| Electricity | 5.24 | |

| Water | 1.86 | |

| Council Rates | 2.55 | |

| Telephone/Internet | 4.50 | |

| 16.05 | ||

| Education – (Self & Children): | ||

| School fees | 18.00 | |

| Uniform/Shoes | 2.50 | |

| Books | 3.00 | |

| Public Transport | 2.45 | |

| Pocket Money | 5.00 | |

| 30.95 | ||

| Entertainment: | ||

| Sport & Theatre | 4.50 | |

| Gym | 1.30 | |

| Pets | 0.99 | |

| Cigarettes | 6.50 | |

| 13.29 | ||

| Health Insurance | 2.26 | |

| Other Expenses | 71.71 | |

| Total Expenses | 161.52 | |

| Net Cash Flow | 31.66 | |

| Opening Bank Balance | 17.41 | |

| Closing Bank Balance | 49.07 | |

| Expected Income | 325 | |

| Shortage of Fund | -275.93 | |

Explanation: Cash flows are sources and uses of money. Primary sources of funds are income from work, savings, investment return, insurance proceeds, and other income events. Regular living expenses, education costs, and other planned expenses are the primary use of funds.

The Cash Flow illustrates four primary financial elements; income, investment, expenses, and cash sources.

The sources of cash that are being used to pay for planned living expenses and to cover special expenses such as education are to be earned. During the working years, income from employment is generally the primary source of cash to cover expenses.

The combination of Total Sources and Living Expenses can create a surplus or shortage. A shortage indicates that expenses exceed incomes and sources. A surplus can indicate that incomes exceed expenses. As they are expecting to get a fund of $325000 thus create a shortage of their fund of ($275930). And it may happen as it will be balanced after getting that expected balance.

References

Account, C. (2017). Bank Account Summary.

Bragg, S. (2017, 07 12). Statement of cash flows overview.

Care, H. (2017). Summary of Benefits and Coverage.

Coach, A. (2017). What is the income summary account?

Dictionary, B. (2017). net worth statement.

Draw, S. (2017). Monthly Expense Summary.

Planning, F. (2017). What is Financial Planning?

Written by

Email: [email protected]